Understanding XBRL Reporting and Compliance in Malaysia

The Rise of Digital Reporting with XBRL

In November 2018, Malaysia took a significant step toward digital transformation in financial reporting by introducing eXtensible Business Reporting Language (XBRL). This move mirrors similar mandates such as the CIPC in South Africa, ESMA in Europe, and ACRA in Singapore, highlighting a global trend toward digital financial reporting.

MBRS: A Streamlined XBRL Platform

To simplify and standardize financial reporting, Malaysia’s Companies Commission (SSM) has introduced the Malaysian Business Reporting System (MBRS), an XBRL-based platform for submitting annual reports. This system enables both public and private companies to seamlessly comply with MBRS requirements, making the process of financial reporting more efficient and accessible.

Navigating XBRL Compliance in Malaysia

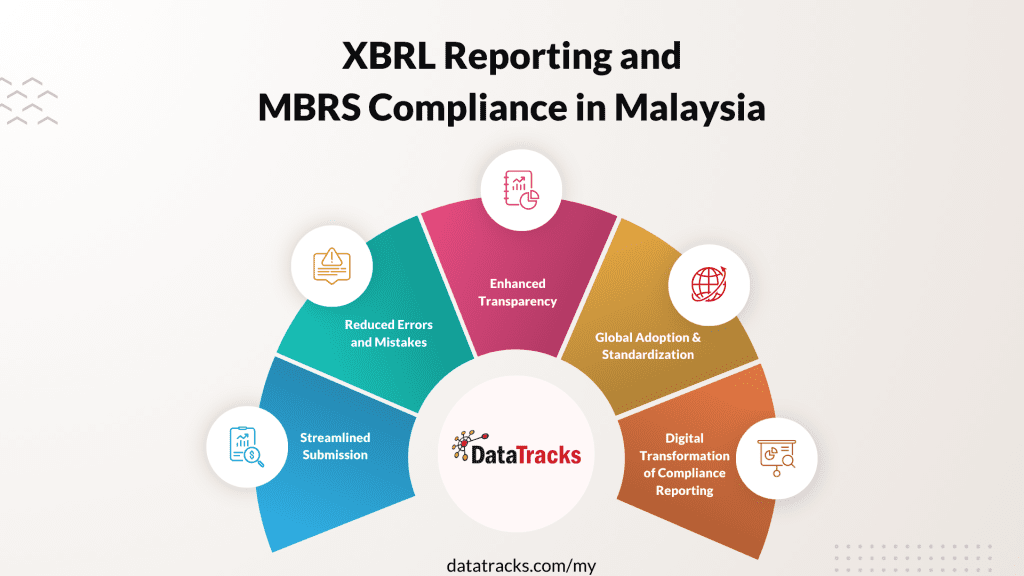

With the XBRL mandate on the horizon, it’s crucial for companies to understand how to comply with MBRS requirements. The XBRL format offers standardized reporting, reducing inconsistencies and enhancing the exchange of financial information. This shift not only streamlines internal processes but also improves transparency and accessibility for regulators, stakeholders, and investors.

XBRL and MBRS Requirements

The Digital Transformation of Compliance Reporting

The introduction of XBRL reporting and the Malaysian Business Reporting System (MBRS) has revolutionized compliance reporting for companies in Malaysia. This shift has simplified processes and ensured better adherence to the requirements of the Companies Commission of Malaysia (SSM).

The introduction of XBRL and MBRS has made compliance reporting easy with SSM in Malaysia. Here’s how:

Facilitates Submission of Annual Financial Statements

MBRS is a digital platform based on the XBRL format, designed to facilitate the submission of various reports:

- XBRL Financial Statements and Reports: MBRS allows companies to easily submit XBRL-formatted financial statements, reducing manual intervention and ensuring consistency across submissions.

- Annual Returns: The platform also supports the submission of annual returns, meeting SSM compliance requirements with minimal effort.

- Exemption Applications: MBRS simplifies the process of applying for exemptions, making the overall reporting process seamless.

Less Scope of Mistakes and Errors

One significant advantage of the XBRL format is its ability to minimize errors:

- XBRL Taxonomy: MBRS uses a structured XBRL taxonomy and tagging system as defined by SSM, ensuring standardized reporting.

- Quality Checks: The system includes quality checks that automatically highlight errors before final submission, minimizing manual corrections and enhancing reporting accuracy.

Improves Transparency in Business Information

XBRL reporting contributes to greater transparency:

- Structured Information: The XBRL format brings consistency to business information, providing a framework that is machine-readable and minimizing misinterpretations.

- Permanent Records: Information submitted through MBRS is stored as a permanent record, enabling easy comparison of data over time.

Global Adoption and Standardization

The adoption of XBRL reporting through MBRS aligns with a global trend:

- Global Impact: Countries worldwide, including South Africa, Europe, and Singapore, have adopted XBRL reporting, highlighting its significance.

- Consistent Framework: XBRL taxonomy ensures standardization across industries and regions, simplifying data analysis for stakeholders, regulators, and investors.

mTool – Helps Companies File XBRL Reports in Compliance With MBRS Requirements

Ease and accuracy are the key parameters that make companies prefer XBRL filing through the MBRS platform. mTool, or the preparation tool, is the most important aspect of MBRS filing that enables error-free compliance with SSM. Even beginners can use the tool effortlessly to ensure a streamlined reporting process.

Make Your Way Towards MBRS Filing by Outsourcing XBRL Requirements

From preparing financial statements and filing payments to adding a digital signature and submitting reports, the MBRS system has standardised the complete reporting process in Malaysia. With the MBRS system, you can ensure optimum resource utilisation and accurate reporting for your company.

You can ensure submitting error-free reports post-XBRL mandate by outsourcing your XBRL filing to a trusted vendor like DataTracks. With 19+ years of experience in the industry, DataTracks has become a global leader in XBRL services and compliance reporting. The experts at the company have prepared over 400,000 compliance reports for more than 28,000 clients in 26 countries.

So get in touch with a DataTracks expert at +60-392-126-125 or email enquiry@datatracks.my TODAY to learn more about their XBRL services!

FAQs on XBRL Reporting Malaysia

What are the requirements for XBRL reporting in Malaysia?

Reports must adhere to the XBRL taxonomy defined by the SSM, categorizing financial data into a consistent framework. This ensures standardization across submissions. Additionally, companies must tag data appropriately and submit it electronically through the Malaysian Business Reporting System (MBRS) platform.

How does XBRL reporting improve compliance in Malaysia?

XBRL reporting improves compliance in Malaysia by standardizing financial reports submitted to the SSM. This reduces errors, facilitates electronic submissions through the MBRS platform, and ensures consistency in reporting across all industries, meeting regulatory requirements.

What are the benefits of using XBRL for financial reporting?

XBRL provides several benefits, including standardization, reduced manual errors, improved transparency, easier comparison across industries, and quick data analysis. This enhances compliance and meets SSM requirements efficiently.