FATCA & CRS Initiative

The FATCA/CRS regime was brought into force to detect and bring into undisclosed record assets held by citizens in foreign countries, by imposing reporting obligations on the Financial Institutions (FFIs) of each participating country.

The Need for FATCA/CRS Reporting

Foreign citizens residing in the EU were subject to adverse effects, due to FATCA/CRS, including frozen savings accounts or being denied access to banking services, due to the reluctance of financial institutions to follow costly FATCA/CRS reporting procedures.

In its efforts to improve transparency and combat tax evasion, the OECD and the IRS have reached an agreement to enforce a systematic reporting framework that acknowledges the complications faced by foreign citizens. Recent developments and advancements regarding FATCA/CRS have opened up a new dimension, boosting information exchange between the EU and other countries, and improving transparency globally

When FATCA Reports be filed?

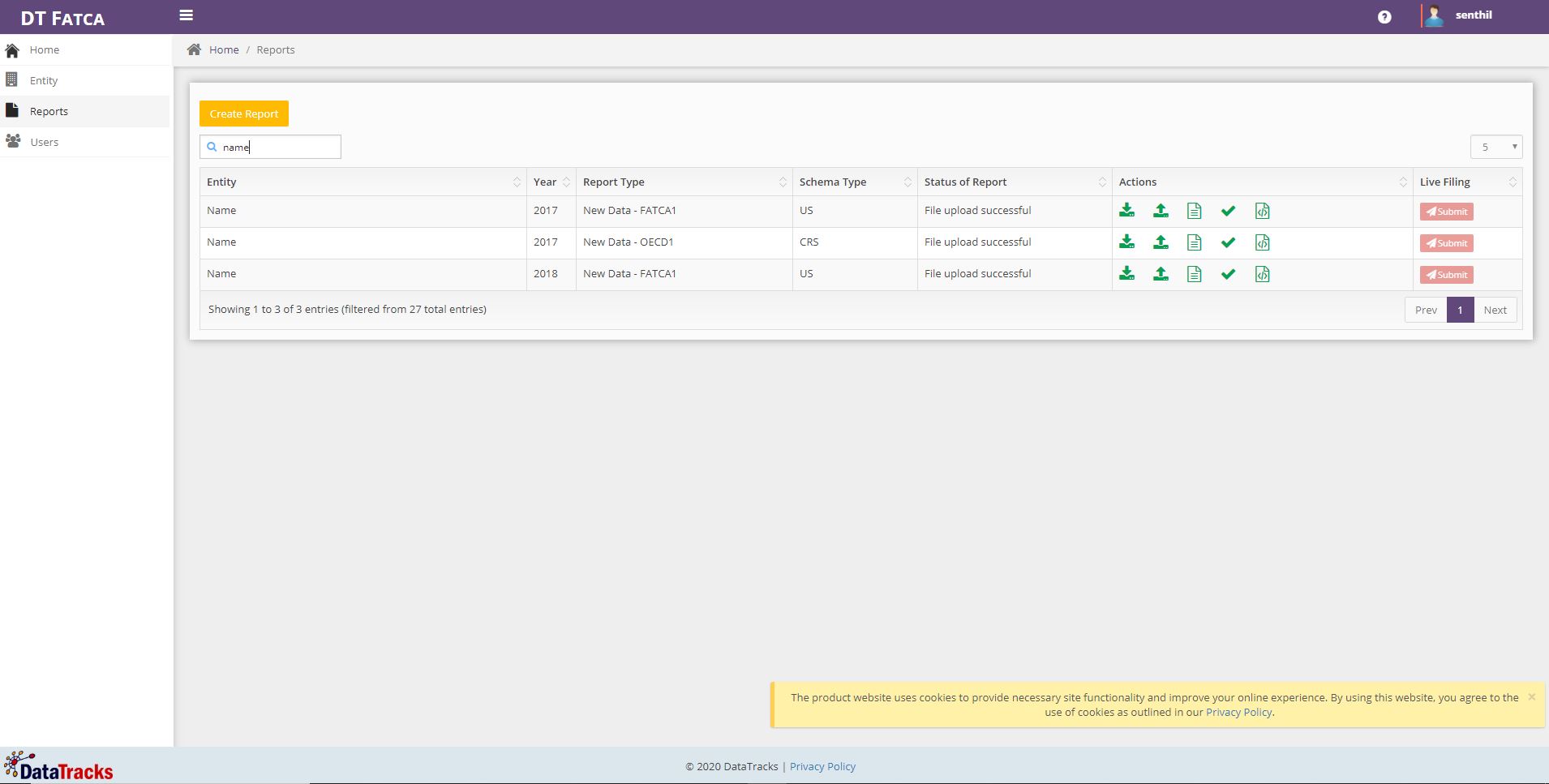

Foreign Financial Institutions (FFIs) are obliged to prepare FATCA/CRS reports in XML format annually.

How DataTracks can Help?

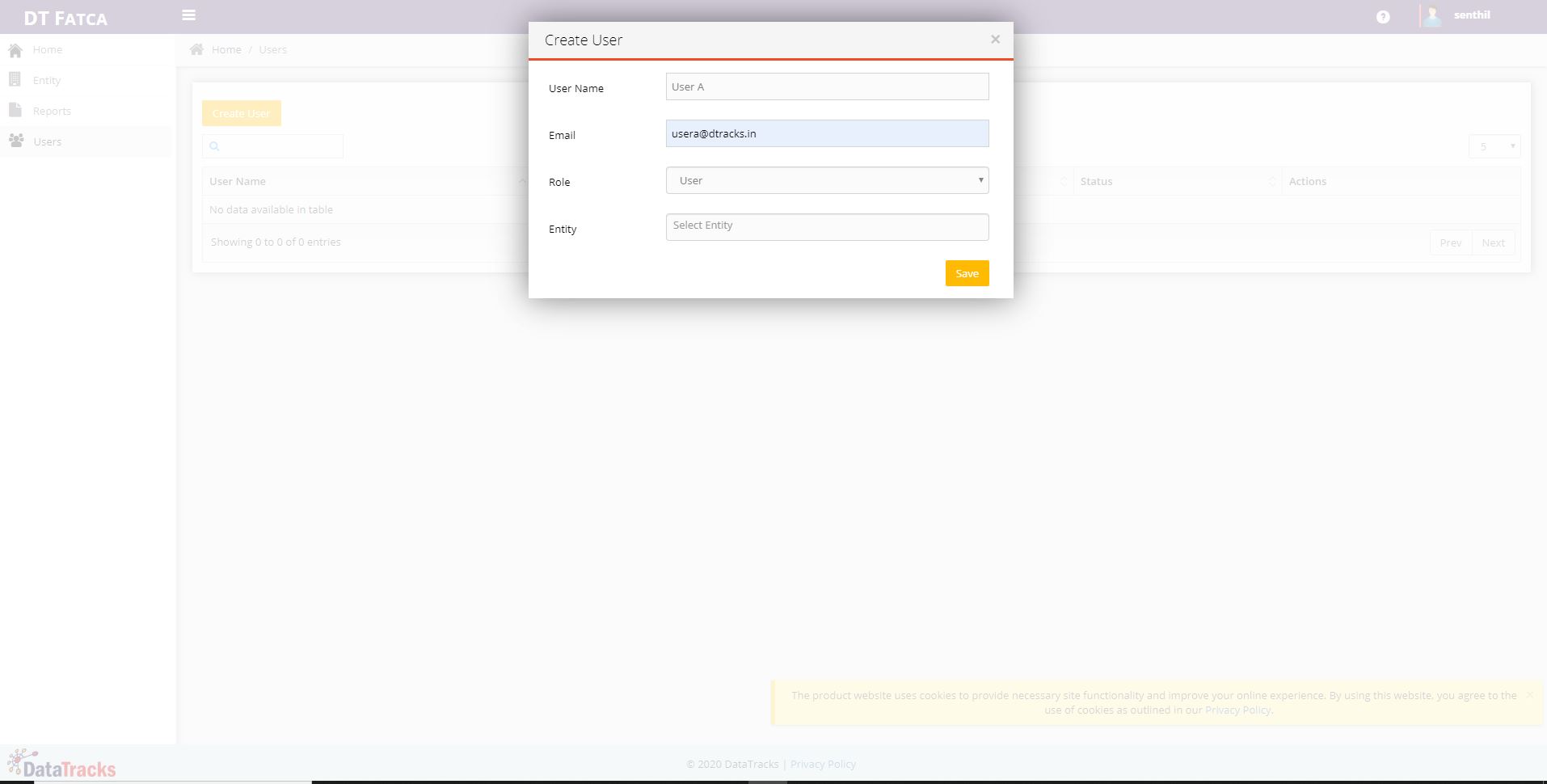

FATCA/CRS compliance is, without a doubt, complex and time-consuming. It requires collaboration among several business lines and geographies. Deploying a comprehensive FATCA/CRS solution can help to significantly reduce validation errors and costs.

Making Accounts Reportable Under FATCA

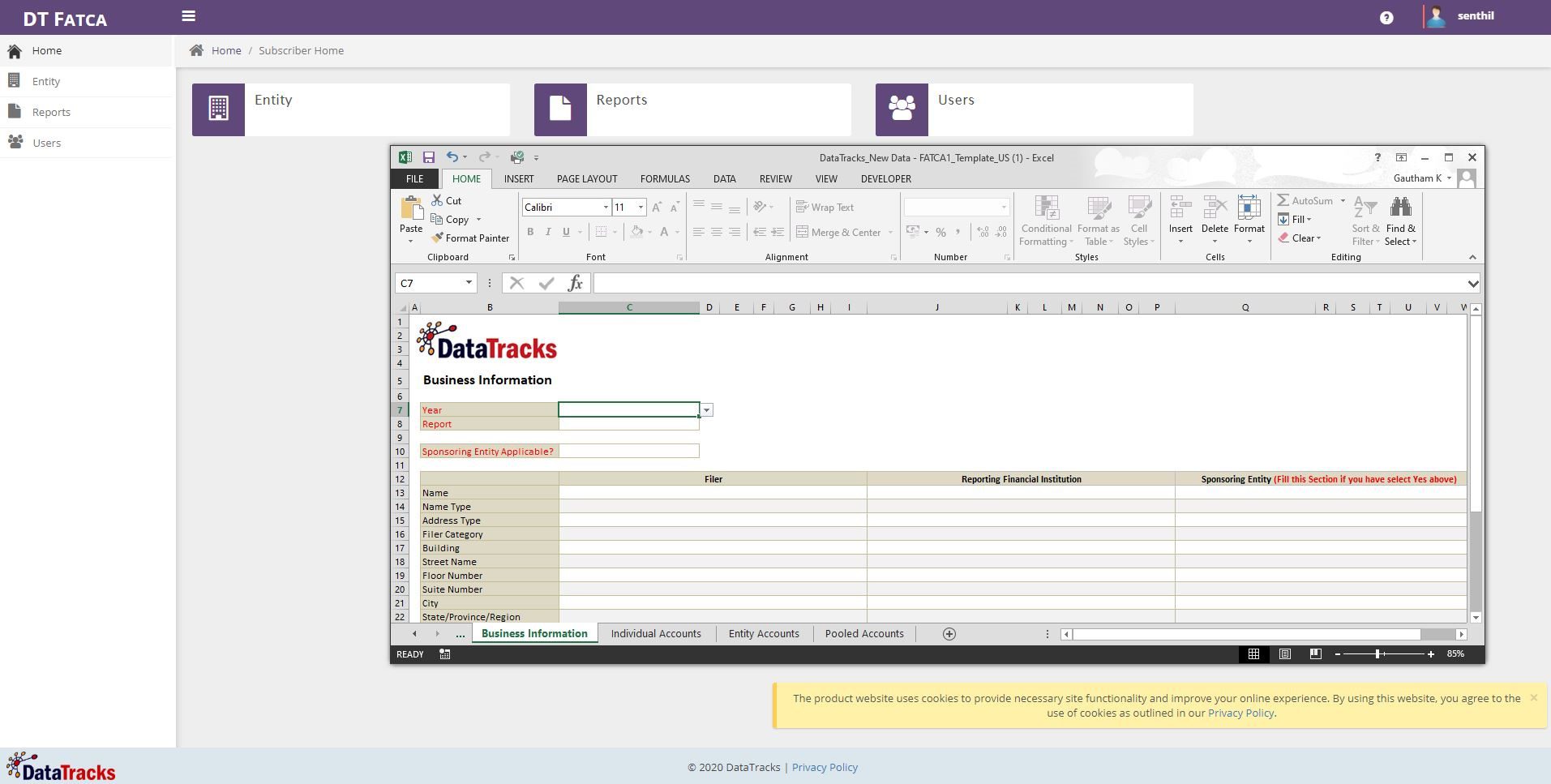

The FATCA/CRS reporting services from DataTracks aim to assist financial enterprises in linking accounts of individuals and entities across different business units, facilitating aggregation by referring to data elements such as customer name, ID and tax identification number.

Error-free, Highly Authoritative Reports

The inbuilt validation engine of the DataTracks solution ensures that all your reports are compliant with FATCA/CRS validation rules. Furthermore, the errors and possible corrections are listed, thereby reducing the chances of inaccurate data being submitted.

Automating Reportable Accounts under FATCA/CRS

The FATCA/CRS reporting solution from DataTracks aims to assist financial enterprises in collating accounts of individuals entities across different business units, facilitating aggregation by referring to data elements such as customer name, ID and tax identification number.

Maintain FATCA/CRS Compliance Status

Our team of XBRL/XML experts boasts 17+ years of experience in multiple taxonomies/schema. That is why each FATCA/CRS report generated is as per the IRS/OECD requirements, the supervisory authority, and the local tax authority, to ensure that FATCA/CRS compliance is intact.

By solving complex FATCA/CRS reporting challenges, DataTracks aims to improve the reporting process of foreign financial institutions.