Managed Tagging Services For Preparation of XBRL Reports

19 years. 26 countries. 28,000+ clients. 400,000 reports.

DATATRACKS INDIA – Best XBRL Service Provider

Streamlined XBRL Services for Seamless Regulatory Reporting

Do you need to prepare compliance reports in XBRL format for filing with the Ministry of Corporate Affairs (MCA) ?

Consider outsourcing your XBRL work to our fully managed tagging services.

Save time, reduce risks and produce error-free compliance reports.

Why Choose XBRL for Your Financial Reporting?

XBRL financial statements allow for a more efficient, accurate, and reliable way of communicating financial data in the XBRL format. Thanks to XBRL taxonomy, data can be uniformly presented, making it easier for investors, regulators, and stakeholders to analyze and compare financial information. However, the intricacies of XBRL reporting, from understanding the applicability of the XBRL format to ensuring compliance with the latest MCA XBRL filing requirements, can be daunting. This is where our expertise comes into play.

Our customers include:

- Companies listed in NSE and BSE

- Accountancy and Audit Practices

- Practising Company Secretaries

- Subsidiaries of Foreign Companies

- Multi National Enterprises

- Companies listed in NSE and BSE

- Accountancy and Audit Practices

- Practising Company Secretaries

- Subsidiaries of Foreign Companies

- Multi National Enterprises

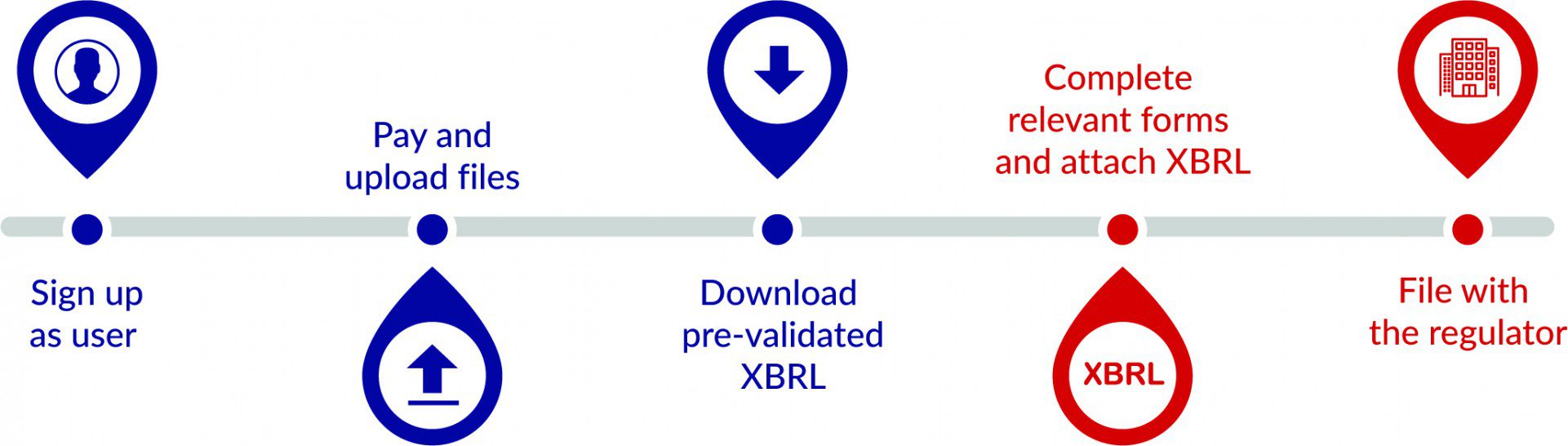

How it works

Completed by you/Company Secretary/Chartered Accountant

Here’s an overview of our process

- Register with us as a user.

- Set up the entities (companies) for which XBRL conversion is required.

- Select relevant taxonomies and turnaround choice.

- Pay and upload finalized audited financial statements.

- Download pre-validated error free XBRL output on scheduled turnaround date.

- Review and submit to the Regulator along with relevant forms.

Finalize your accounts and leave the rest to our team of financial professionals with IGAAP and Ind AS expertise who would ensure a hassle free experience in preparing XBRL reports.

Country By Country Reporting

The BEPS (Base Erosion and Profit Shifting) Action Plan 13 by OECD describes the Country-by-Country Reporting (or CbCR) framework for multinational companies to report the key metrics with an appropriate tax authority.

The Indian Government has implemented CbCR filing requirements for Multinational Enterprises based on group revenue and country of residence of parent entity of the group.

In India the governing authority is the Central Board of Direct Taxes (CBDT).

The mandate which came into force for fiscal year beginning on or after 1 April 2016 applies to Multinational Enterprises with annual consolidated group revenue equal to or exceeding INR 5,500 crore in the previous year. Regulations extend to subsidiary entities as well, and Indian entities are allowed to act as surrogate of foreign entities. An Indian entity with a foreign parent has to notify the Indian authority in form 3CEAC, on or before sixty days prior to the date of furnishing the Country by Country Report. Usually the CbCR should be filed within 12 months from the end of reporting accounting year.

According to the offline utility available on the Income-tax Department’s website, Form 3CEAD has been divided into the following four parts:

- Form 3CEAD, which includes the basic details of an Indian reporting entity

- Part A, which is in the same format as Table 1, according to OECD CbCR

- Part B, which is in the same format as that of Table 2, according to OECD CbCR

- Part C, which contains additional information similar to that included in Table 3, according to the OECD CbCR, and contains verification details, i.e. details pertaining to the MD or Director.

Accordingly, while the xml (according to the OECD format) cannot be used as it is, but to a large extent this information can be used while filing CbCR in India. In this regard, Table 1 and Table 2 data in the Microsoft excel or CSV format needs to be collated, arranged in a format compatible with the Indian xml schema, certain additional details needs to be added, and thereafter, xml can be generated.

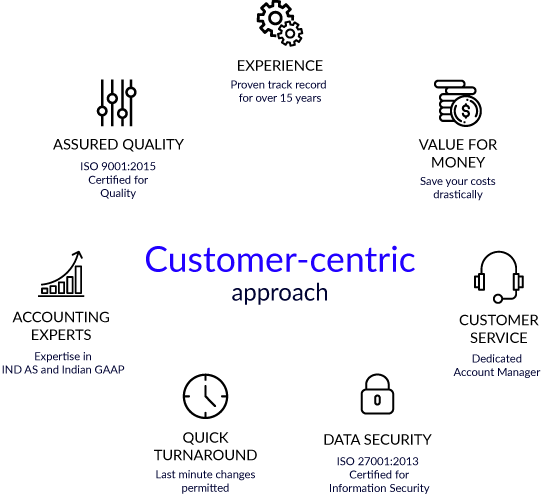

Why DataTracks

Customers speak

DataTracks are really professional right from accepting the order till delivery of the final output, I am really amazed with their follow-up till the completion of job.

I appreciate your timely & superb service, Thank you so much for keeping the word.

Excellent Services & Support. I rate their services & deliverables 5 on a scale of 1 to 5.

You are doing best

Words fail to assist me in expressing my gratification.Just in a nutshell, it is amazingly and unbelievably outstanding on all counts, starting from seamless interaction to initiate the process till output delivery schedule maintenance.Simply the BEST.

Extremely you are doing well. Expect your support in future.

We are using your services for the second year and satisfied. All the very best.

Be it XBRL delivery or client’s obligations – Data Tracks is always ahead of committed time line

I really appreciate your professional approach & giving value to customers.

V Ramasubramanian A.C.S., A.C.M.A.

CS Reshma Sarda

CA Sachin Agarwal ACA

Practising Company Secretary with over 10 years of experience

Company Secretary, leading Manufacturing Company

Company Secretary, Established Manufacturing and Export company listed in Indian Stock Exchange

Partner of a Chartered Accounting Firm

Company Secretary, Leading Chemicals Company

Practising Company Secretary handling 50+ clients

Schedule A Demo