12 Regulations. 19 years. 26 countries. 28,000+ clients. 400,000 reports.

12 Regulations. 19 years. 26 countries. 28,000+ clients. 400,000 reports.

DATATRACKS

Solvency II Pillar 3 reporting

For Insurance and Reinsurance Companies

Solvency II Framework

Solvency II is a risk-based capital regime based on three pillars:-

- Pillar 1 – includes the calculation of liabilities and risk-based capital

- Pillar 2 – comprises a supervisory review process for the measurement of risk, against which capital must be held

- Pillar 3 – focuses on disclosures, reporting and transparency requirements of the risk and capital requirements

Due to the simplicity of the regulatory framework for the insurance market, a lack of an economic risk-based approach and differences in implementation across the EU, the existing regulatory regime needed to be revised.

The Need for Solvency II Pillar 3

The Previous Solvency II framework had several shortcomings and loopholes, which resulted in some serious challenges for the supervision of the insurance industry. Considering this, EIOPA (European Insurance and Occupational Pensions Authority), the supervisory authority and financial regulatory institution of the EU, introduced the new solvency requirements with a stringent regulatory framework, to ensure that insurers have sufficient capital to withstand adverse events, both in terms of insurance risk (as under the previous regime), and now also in terms of economic, market and operational risk.

Solvency II Pillar 3 Mandate

As of January 2016, due to the Solvency II mandate, insurance and re-insurance companies across the European Union and the UK have been required to submit detailed financial information reports, in XBRL Format (eXtensible Business Reporting Language), to their national supervisors, as per the requirements laid down by EIOPA.

When Solvency II Pillar 3 Reports be Filed?

The reports must be filed on a quarterly and an annual basis. The submission deadline for quarterly submissions is usually around 40 days from the end of the reporting period. For annual submissions, it is 90 days from the end of the reporting period.

Challenges Faced in Solvency II Reporting

How to Choose the Right Solvency II Pillar 3 Solution?

Since the introduction of Pillar 3, insurers are witnessing huge organisational and process implications with regard to production, collation and management of financial data. Therefore, there is a need to find the right Solvency II Pillar 3 solution. The problem here, is that most service providers are leveraging solutions for Pillar 1, Pillar 2 and Pillar 3 reporting, which leads to a haphazard reporting process. This is why companies should consider a separate application/system for Pillar 3 reporting Considerations when scouting for a robust Solvency II Pillar 3 solution:-

- Cloud-based solution with data on secured servers

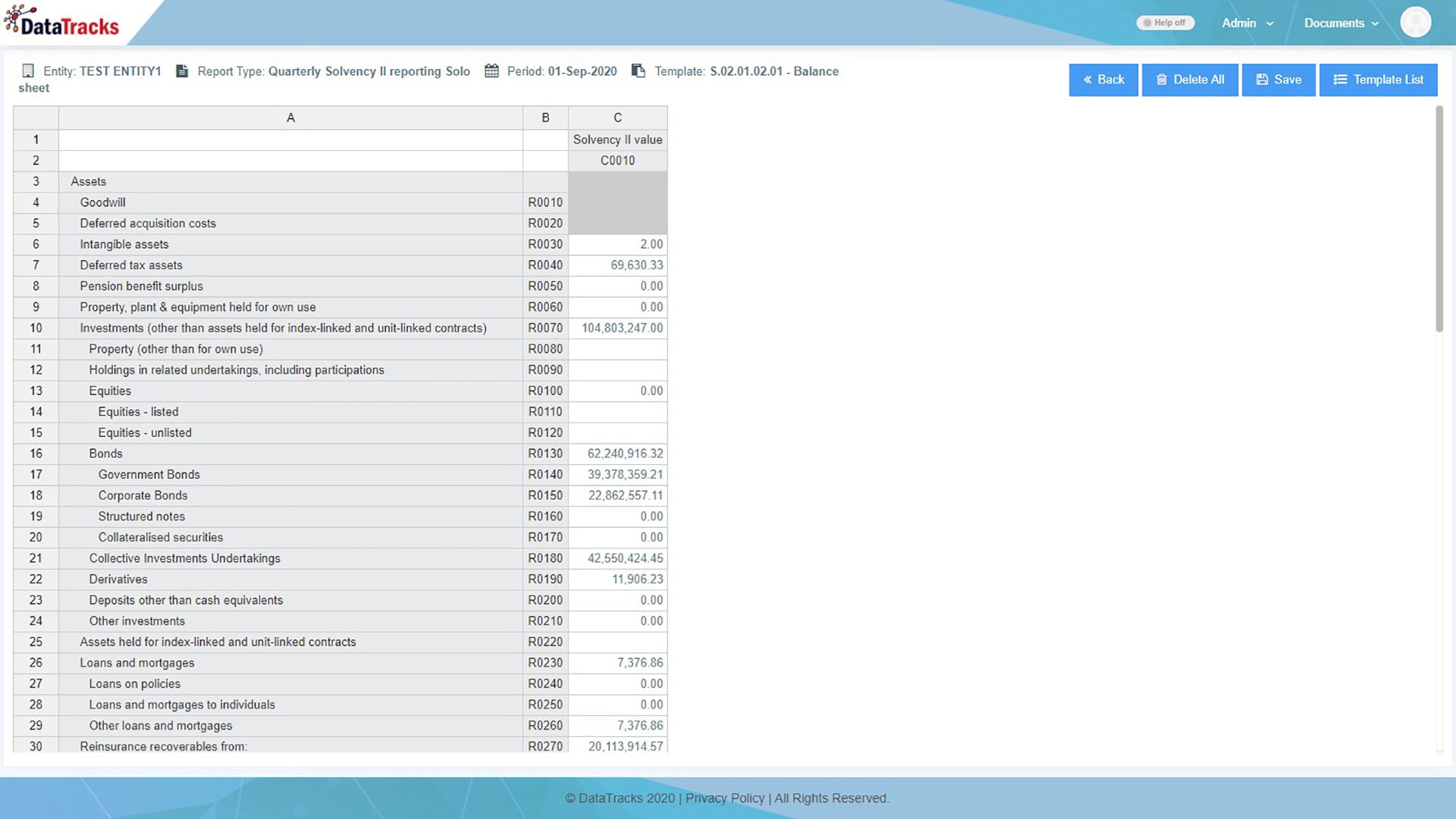

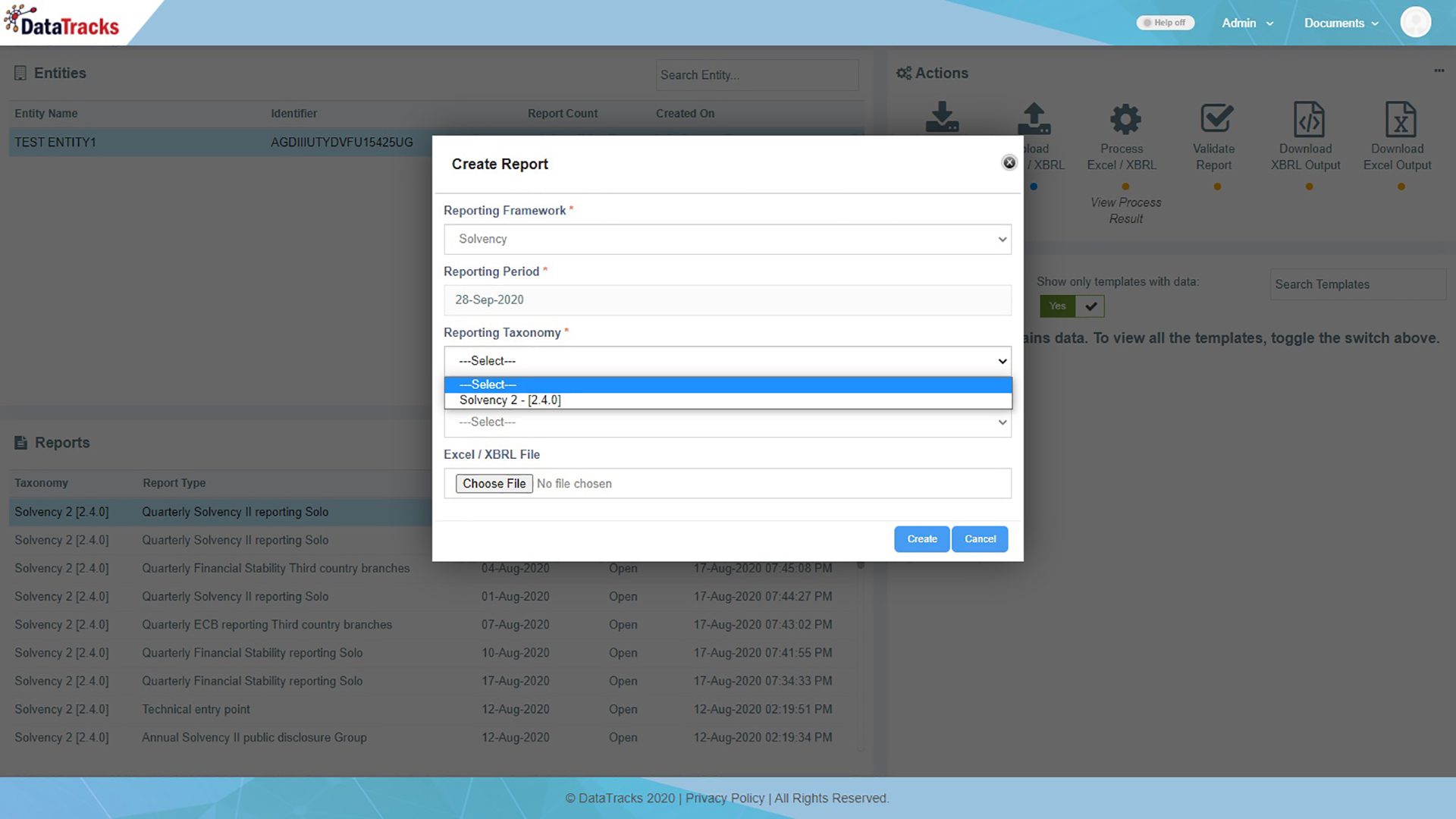

- Automated and flexible data entry and easy upload process

- Flexibility to connect with external data sources for a seamless reporting process

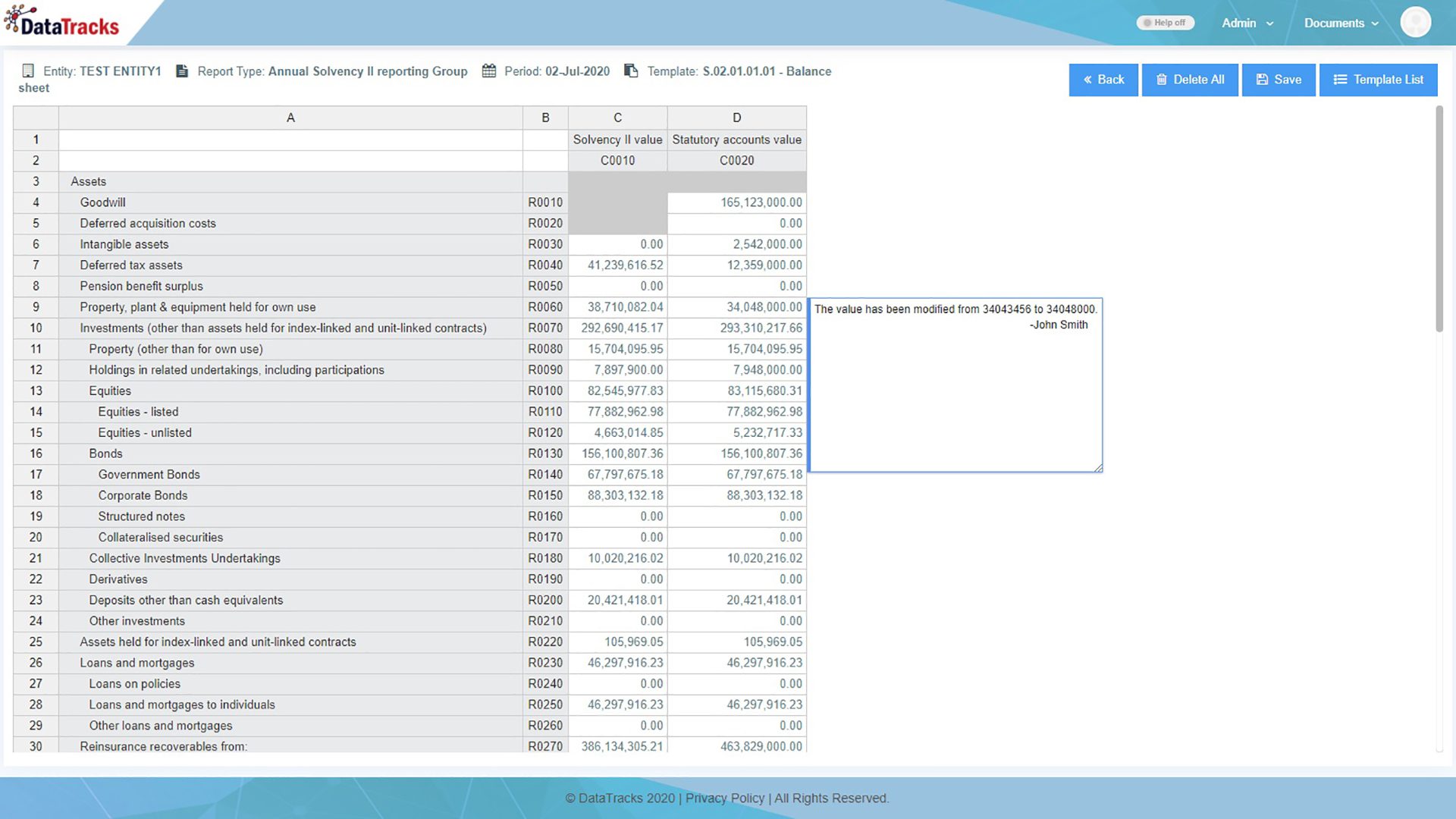

- Collaborative workflow connecting multiple users (Preparer, reviewer, etc.)

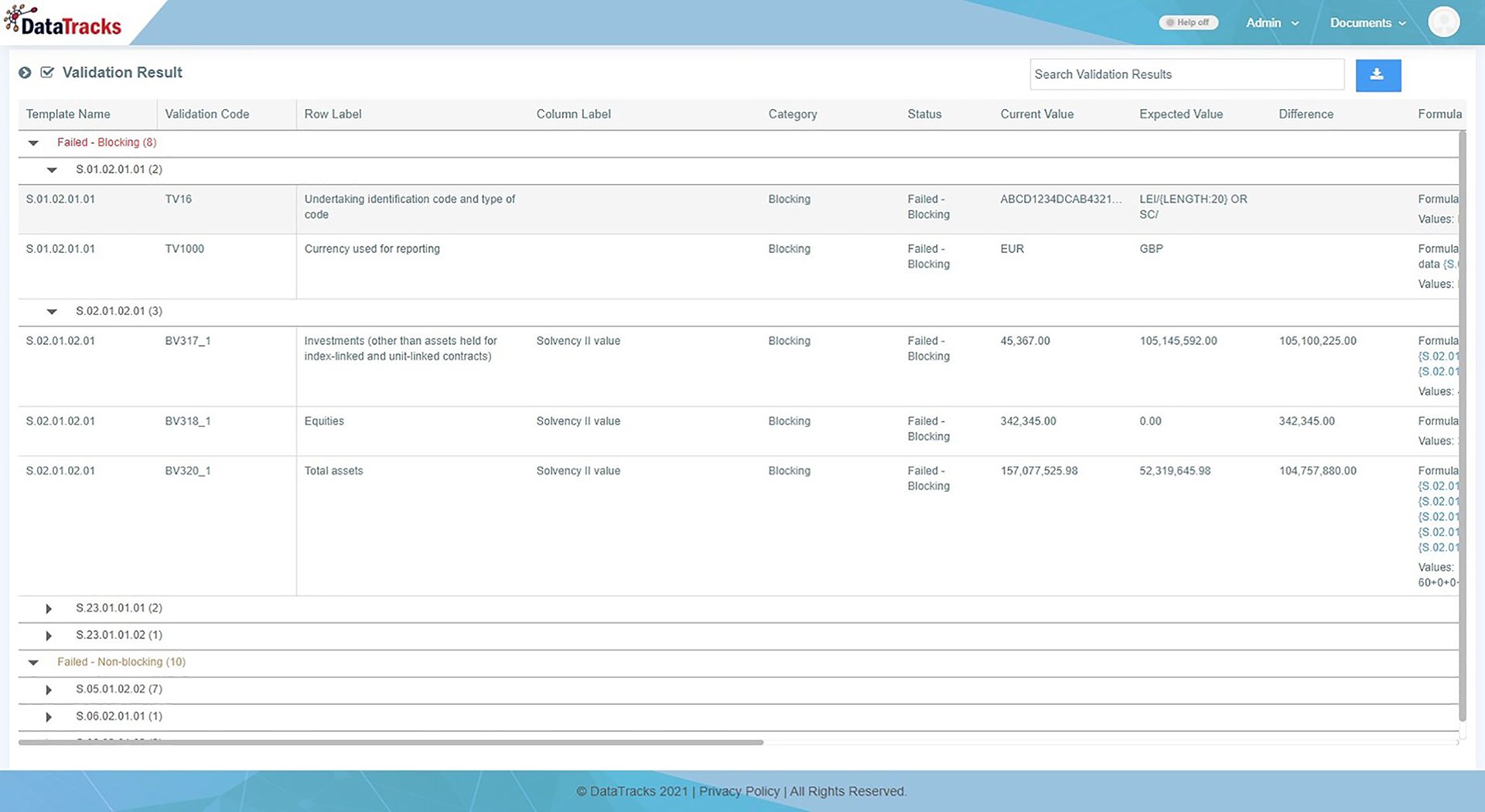

- Comprehensive validation process

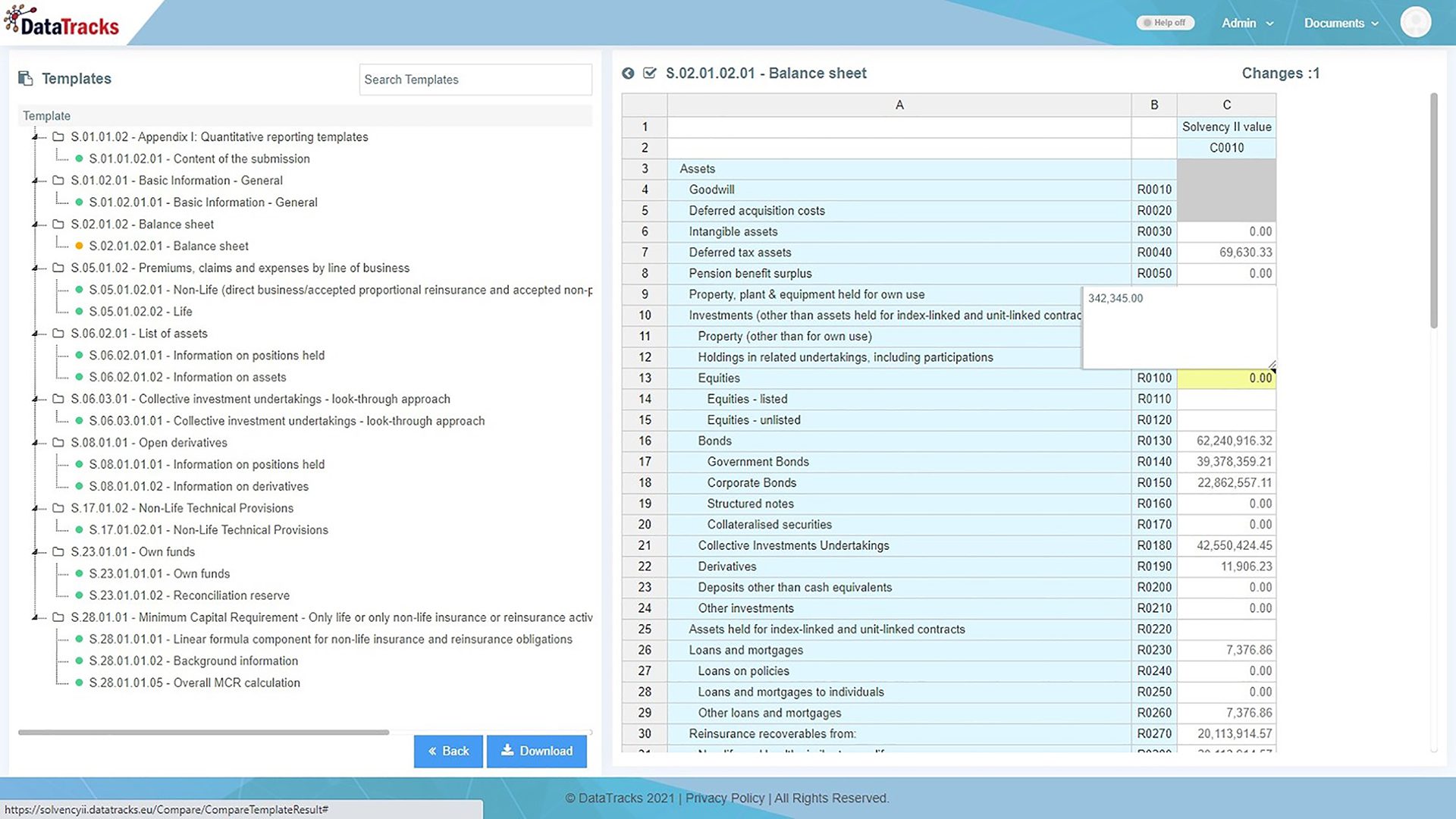

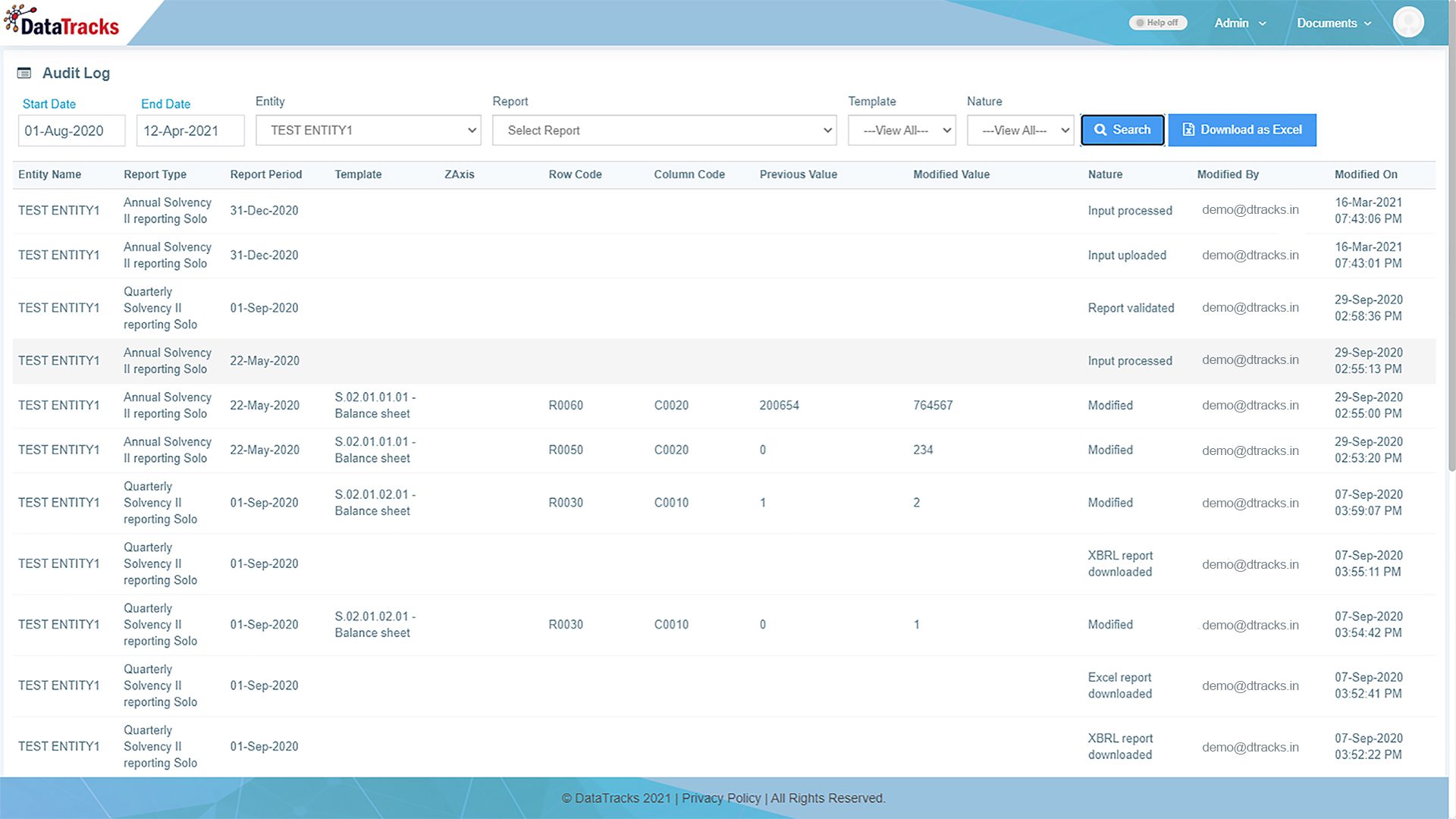

- Comparability of report versions at regular intervals

- Agility to adapt to the latest regulatory changes by EIOPA

- User-friendly interface and experience with quick TAT

- High-quality XBRL report output as per regulator’s requirements

DataTracks - Benefits beyond Compliance

Given the complicated nature of the regulatory compliances of the Solvency II framework, a flexible and tailored solution is what you need. That is the main focus of DataTracks.

Error-free Reports

End-to-end Standard Solvency II Solution

Agility and Quality

Data Security

Flexible Pricing Model

Features That Differentiate Us