Seamless CIPC AFS Submission: Transforming PDFs to iXBRL Format

There are times when technology meets a significant milestone. And for South Africa-based companies, that milestone was the introduction of iXBRL for financial reporting. This was when digital transformation moved to the forefront of many organizations.

To avoid disruption, many companies have increased their focus on automation and technology.

Converting PDF to iXBRL Format of AFS:

This rapid shift from converting PDF to iXBRL format has become a blessing in disguise.

It offers a solution wherein massive amounts of financial data can be easily and accurately processed to identify insightful information. These factors help turn around the quality of your company’s financial data into a key competitive advantage.

Using Inline XBRL

iXBRL data are used by financial analysts, credit risk agencies, industry researchers, auditors, investors, regulators, and other users to gain insights that influence crucial business decisions. Companies that consistently report high-quality iXBRL data can set themselves apart from the marketplace. It can also benefit the investors more broadly because iXBRL data helps make better decisions.

iXBRL Data Quality

By imposing several quality checks, the CIPC ensures that data quality is maintained. Additionally, since the financial reports cannot be submitted until every quality check is met, regulators and data users can rest assured that it is error-free.

High-quality data allows users to quickly and easily analyze financial data without going back and forth from page to page, which is the case with PDF format.

How can a Robust iXBRL Tagging Quality Control Process Help?

iXBRL tagging is a compliance exercise. A robust quality control process with correct tagging can enhance the wholesomeness and accuracy of the reports. Although the iXBRL tagging is often applied at the end of the reporting process when the conversion is done from a particular format to iXBRL, companies should consider executing it with the same rigor as other reporting processes. This can not only help them maintain the quality of their financial data but also streamline their reporting processes.

How to convert PDF to iXBRL format for CIPC Filing?

Enhancing Financial Data Accessibility and Usability through Inline XBRL (iXBRL)

The conversion of Portable Document Format (PDF) financial statements to Inline eXtensible Business Reporting Language (iXBRL) represents a substantial advancement in facilitating data access and usability.

iXBRL strategically merges the strengths of XBRL’s tagged data with the well-established readability of PDFs. This permits both human and machine comprehension of financial information in a more efficient manner To ensure accuracy, compliance, and functionality, the PDF to iXBRL conversion process necessitates the meticulous execution of several critical stages.

Demystifying iXBRL

iXBRL is a standardized format that enables the incorporation of XBRL data directly within an HTML document. This empowers the document to be displayed using any standard web browser, while preserving the familiar formatted text and graphics akin to a PDF.

However, it also incorporates machine-readable XBRL tags embedded discreetly within the HTML code. These tags serve to unlock the potential for automated processing of financial information by software applications, thereby augmenting data precision and minimizing the likelihood of manual errors.

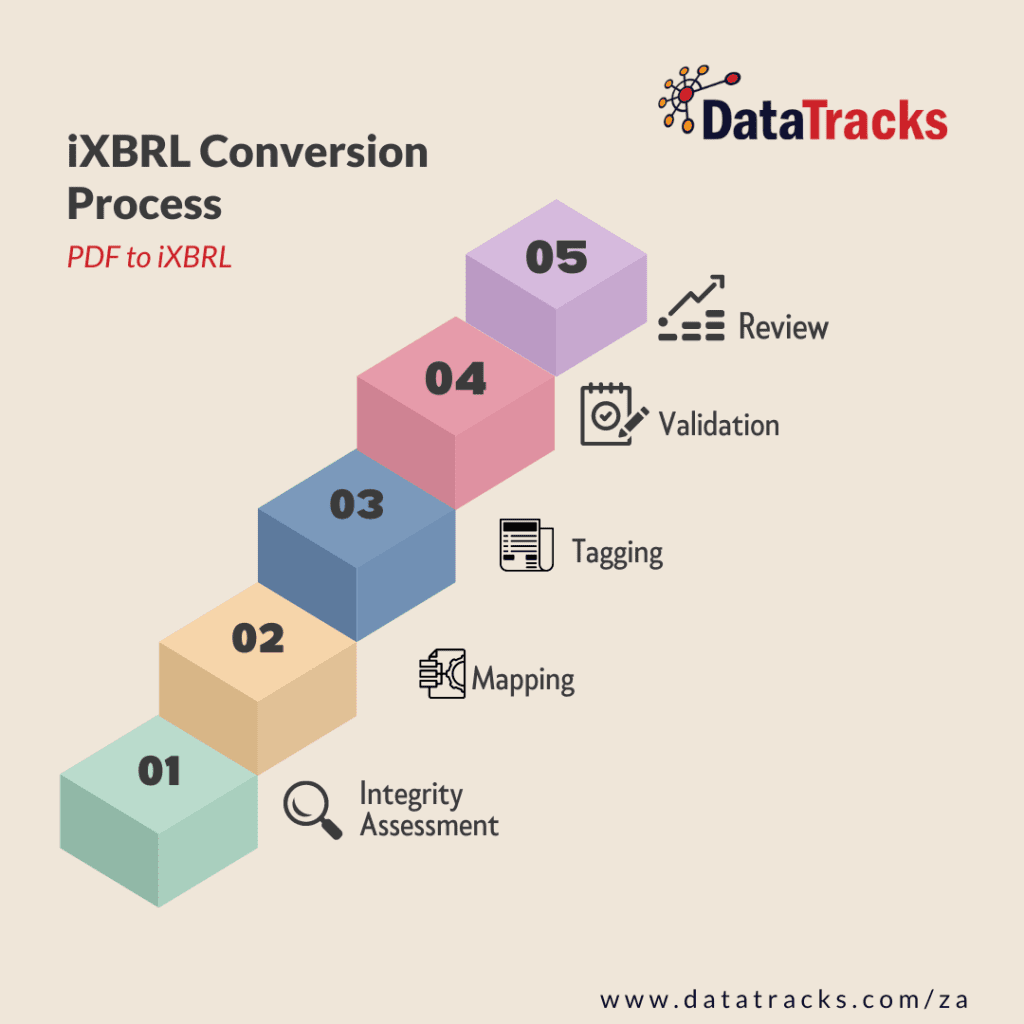

A Multi-Stage Approach to Accurate and Compliant iXBRL Conversion (PDF to iXBRL)

To achieve a successful PDF to iXBRL conversion, a meticulous, multi-stage process is paramount. This section delves deeper into each critical stage, emphasizing the importance of maintaining precision and adherence to regulatory requirements throughout.

Stage 1: Pre-Conversion Document Integrity Assessment

Prior to commencing the PDF to iXBRL conversion, a comprehensive evaluation of the source PDF document is mandatory. This initial step safeguards the completeness, accuracy, and final status of the document. Any modifications introduced after the conversion can create complications and potentially compromise data fidelity.

Furthermore, this stage offers a valuable opportunity to verify that all financial data is presented with utmost clarity and devoid of ambiguity. A well-structured and unambiguous original document significantly facilitates the subsequent mapping and tagging processes.

Given the CIPC’s requirements, companies in South Africa must ensure that AFS is comprehensive and complies with the relevant South African Financial Reporting Standards (SAFRS). This preparatory step is crucial, as any modifications post-conversion can lead to complexities and potential compliance issues.

Stage 2: Mapping – The Foundation of iXBRL Conversion

Mapping involves a meticulous process where each piece of financial data within the PDF is matched to a corresponding XBRL tag based on an understanding of the relevant XBRL taxonomy. This step is foundational because it determines how data is interpreted in the iXBRL format.

Effective mapping requires an in-depth knowledge of the taxonomy’s structure, elements, and extensions that are applicable to the financial data being reported. The goal is to create a comprehensive map that accurately reflects the financial narrative in a structured, machine-readable format. The mapping must be done meticulously to ensure that it reflects the SAFRS and meets the specific reporting requirements of the CIPC for companies in South Africa.

Stage 3: Tagging- Transforming Data into Structured Information

With a complete mapping framework in hand, the conversion process advances to tagging. Specialized conversion software is employed to tag the financial data in the PDF with the appropriate XBRL tags, as determined during the mapping stage.

This transformation is critical as it converts static text into structured, machine-readable information, enabling automated analysis and processing. The tagging process requires precision to ensure that each tag accurately represents the associated financial data, adhering to the CIPC XBRL taxonomy.

Stage 4: Validation- Ensuring Accuracy and Compliance

Post-tagging, the newly created iXBRL document undergoes a validation process. This crucial step checks the document for compliance with the CIPC XBRL taxonomy and identifies any tagging errors or inconsistencies.

Validation tools, often integrated into the conversion software, play a vital role in this phase by providing feedback on the document’s fidelity to the taxonomy standards. Errors identified during validation must be addressed promptly to ensure the iXBRL document meets all regulatory and technical standards.

This step is crucial for companies in South Africa to comply with regulatory requirements and avoid submission errors and also this iterative process may require several rounds of validation to rectify all issues.

Stage 5: Review- A Critical Eye for Detail

A comprehensive review by individuals versed in both financial reporting and XBRL tagging follows the validation process. This dual expertise is crucial for a thorough examination of the iXBRL document, ensuring that all financial data is represented accurately and consistently.

Given the specific requirements for AFS submissions to the CIPC, this review must ensure that the financial data in the iXBRL document is accurately represented and compliant with SAFRS and CIPC mandates.

The review process involves cross-referencing the iXBRL document against the original PDF to confirm that the conversion has not introduced any discrepancies. This stage might also involve discussions and consultations among different stakeholders to resolve any ambiguities and ensure the highest level of accuracy and compliance.

Stage 6: Finalization-Ready for Submission and Publication

Upon successful validation and review, the iXBRL document is finalized, marking it ready for submission to regulatory bodies or for public disclosure. Prior to submission, it’s prudent to test the document in various web browsers to verify that it displays correctly, ensuring that the XBRL tags are seamlessly integrated and do not interfere with the human-readable aspect of the document.

It’s essential to perform a final check in various web browsers to ensure the document displays correctly and the XBRL tags do not interfere with the human-readable content, adhering to CIPC’s submission guidelines.

This final check ensures that the document is not only compliant and accurate but also accessible and interpretable by the intended audiences.

The conversion from PDF to iXBRL is a critical process for companies in South Africa to comply with the CIPC’s requirements for AFS submissions. By following these detailed steps, companies can ensure their financial statements are accurately represented in the iXBRL format, facilitating better transparency, compliance, and efficiency in financial reporting within the South African regulatory framework.

Streamlining PDF to iXBRL Conversion with DataTracks

DataTracks’ iXBRL services are designed to assist companies in navigating the complexities of iXBRL reporting, ensuring compliance with regulatory standards such as those set by the CIPC in South Africa. Our services include:

- Expert Conversion: Leveraging a team of iXBRL experts, DataTracks provides meticulous conversion of PDF financial statements into fully compliant iXBRL documents. This includes detailed mapping, tagging, validation, and review processes to ensure accuracy and adherence to relevant taxonomies and regulations.

- Regulatory Compliance: With an in-depth understanding of the regulatory requirements in various jurisdictions, including South Africa, DataTracks ensures that all iXBRL documents meet the specific mandates of regulatory bodies like the CIPC, ensuring smooth and hassle-free submissions.

- Customized Support: Understanding that each company’s reporting needs are unique, DataTracks offers tailored support, guiding businesses through the iXBRL conversion process from start to finish. This bespoke approach ensures that the specific needs and challenges of each client are adequately addressed.

DataTracks offers robust iXBRL conversion software “DataTracks Rainbow”. This software is designed to empower businesses with the tools they need to conduct iXBRL conversions, featuring:

- User-Friendly Interface: The software provides a straightforward, intuitive interface that simplifies the conversion process, making it accessible even to those with limited technical expertise.

- Automated Tagging and Validation: Equipped with advanced technology, the software automates much of the tagging and validation processes, reducing the time and effort required while enhancing accuracy and compliance.

- Real-Time Error Detection: With built-in error detection and correction functionalities, the software allows users to identify and rectify issues in real-time, ensuring that the final iXBRL document is of the highest quality and fully compliant.

Prioritize iXBRL Data Quality Now!

As the use of iXBRL increases in South Africa, companies implement strong iXBRL quality review checks to help them manage their data effectively. With a partner like DataTracks, you can be market-ready to implement PDF to iXBRL format and leverage all its benefits. If your company ready to leverage PDF to iXBRL reporting?

Contact an expert @+27 10 446 9061 / enquiry@datatracks.co.za.

Frequently Asked Questions on Convert PDFs to iXBRL

Why convert PDF documents to iXBRL?

Converting PDFs to iXBRL is often a regulatory requirement for financial submissions, such as the CIPC AFS in South Africa. iXBRL documents offer the dual benefit of being readable by both humans and machines, facilitating better data analysis, greater transparency, and streamlined compliance processes.

Can all financial statements be converted from PDF to iXBRL?

Most financial statements contained in PDF documents can be converted to iXBRL, provided they are structured appropriately and contain clear, comprehensive financial data. The conversion process involves mapping, tagging, validating, and reviewing the data to ensure it aligns with the relevant XBRL taxonomy.

How does the iXBRL conversion process work?

The iXBRL conversion process involves several key steps: preparing the PDF document, mapping the data to the appropriate XBRL tags, tagging the mapped data in the iXBRL format, validating the iXBRL document for accuracy and compliance, reviewing the document thoroughly, and finalizing it for submission or publication.

Do I Need iXBRL Conversion for CIPC Compliance in South Africa?

Yes, you most likely need iXBRL conversion for CIPC compliance if you fall into one of these categories:

- All Companies and Close Corporations: This includes private and public companies, even personal liability companies, as long as they require an audit under the Companies Act or relevant regulations.

- State-Owned Enterprises (SOEs): If your SOE adheres to Generally Recognized Accounting Practice (GRAP) standards, iXBRL filing has been mandatory since October 2020.

- Cooperatives: Cooperatives with an annual turnover exceeding R10 million must submit their annual reports in iXBRL format since October 2022.

Voluntary Conversion may apply to you if:

- Your Company Has a High PI Score: The Public Interest Score (PI Score) is used by CIPC to assess public interest in a company. Companies exceeding a specific PI score threshold (usually 350) can voluntarily use iXBRL for AFS filing.

- Your MOI Specifies iXBRL: If your company’s Memorandum of Incorporation (MOI) mentions filing AFS using iXBRL, then it’s mandatory.

Are there common challenges in converting PDFs to iXBRL?

Common challenges include ensuring data accuracy during the mapping and tagging process, adhering to the specific taxonomy requirements, and validating the iXBRL document for compliance.

When converting PDFs to iXBRL, companies often encounter formatting issues that can affect the readability and professional appearance of their financial statements. These formatting challenges include discrepancies in the alignment, font styles, and overall layout, which are crucial for maintaining the document’s integrity and compliance with regulatory standards.

DataTracks South Africa offers a robust solution to tackle these formatting issues head-on. Our in-house dedicated team is specifically trained to address and solve such challenges, ensuring that the iXBRL documents perfectly mirror the original PDFs in terms of design and format. By utilizing DataTracks’ expertise and advanced iXBRL solutions, businesses can seamlessly overcome formatting issues, ensuring your financial reports are both compliant and accurately reflect your intended presentation.