What is a SPAC?

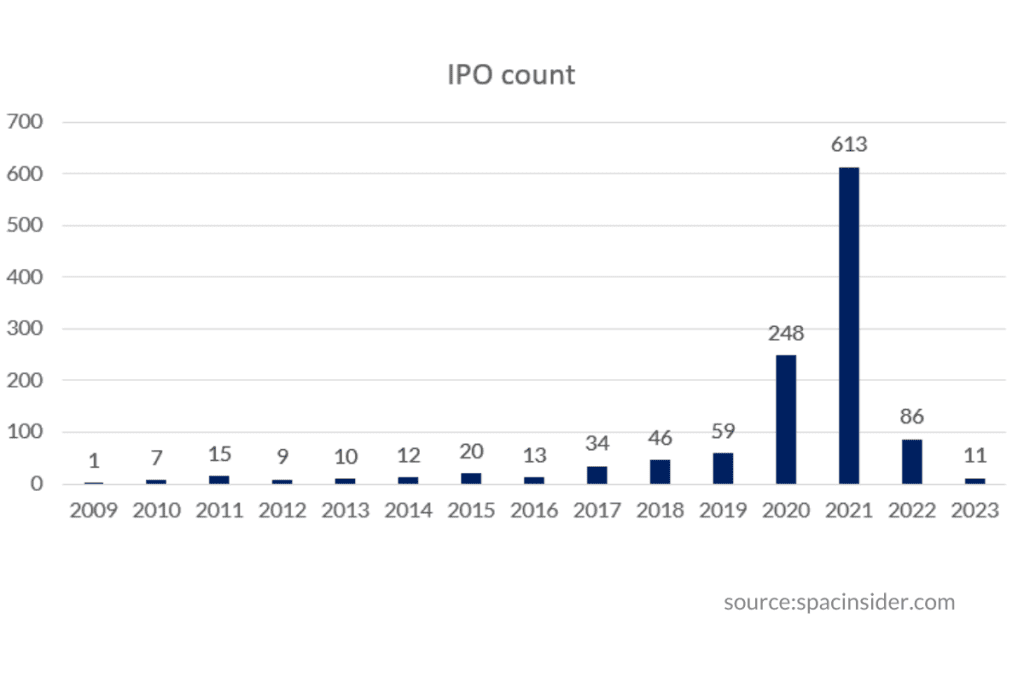

2021 saw a meteoric rise in the number of IPOs, which was largely due to the influence of the increase in the number of Special Purpose Acquisition Companies (SPACs) that went public in the same year. In 2021, US witnessed 1035 companies going public with their IPOs, whereas, in 2022, the number of IPOs dropped to 181.

“Money looking for a promising private company to invest in” is the best way to describe a SPAC. It is a public company that has already gone through the IPO process and is also commonly called the “blank cheque entity.”

SPACs are gaining popularity as a popular vehicle for companies seeking to go public. They are blank-check companies formed to acquire or merge with an operating company within a specified timeframe.

Understanding SPACs and Their Workings

Special Purpose Acquisition Companies (SPACs) have gained significant popularity in recent years as an alternative route for companies to go public. A SPAC is essentially a shell corporation listed on a stock exchange with the sole purpose of acquiring a private company, thus making it public without going through the traditional Initial Public Offering (IPO) process.

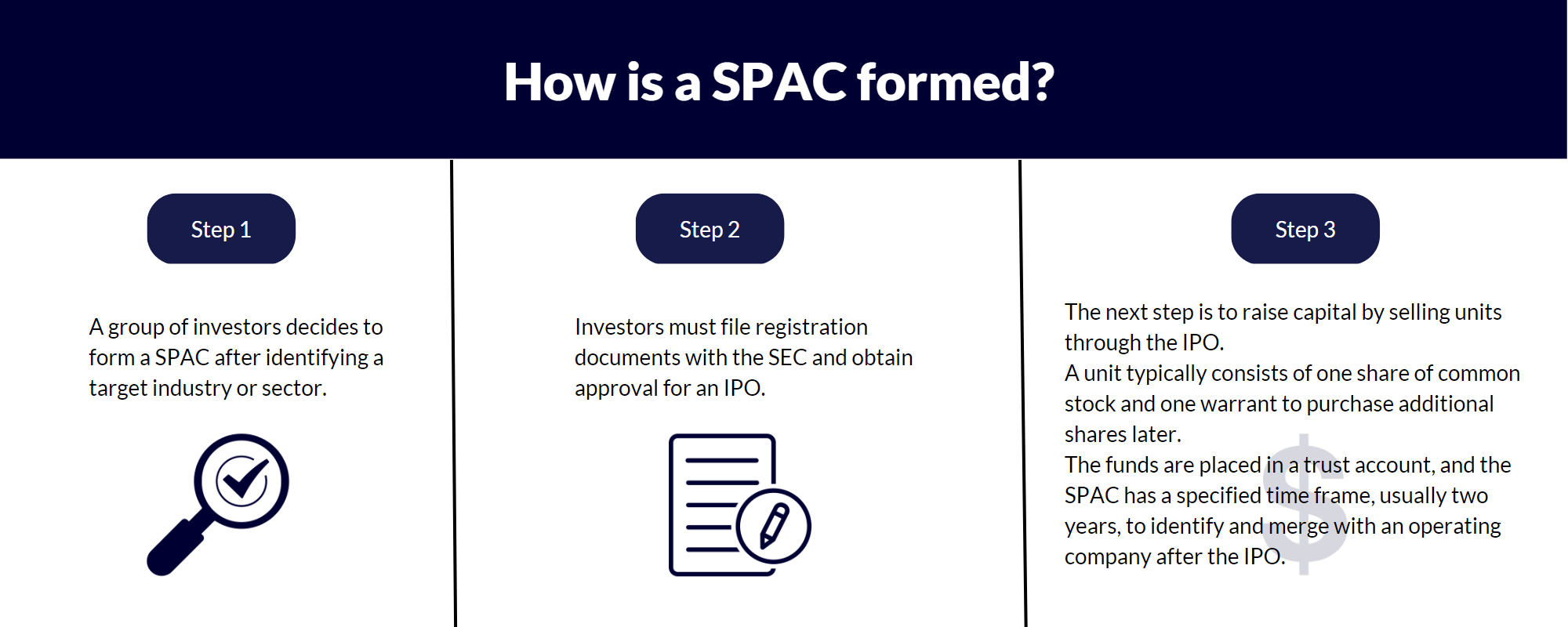

Formation and Fundraising

A SPAC is formed by a group of investors, often referred to as sponsors. These sponsors are typically experienced executives or financial professionals who raise capital through an IPO. The IPO involves selling units, which usually consist of one share of common stock and a fraction of a warrant, to public investors. The funds raised through the IPO are then placed in a trust account. This trust account is protected, meaning that the funds can only be used to complete an acquisition or returned to investors if no acquisition is made within a specified timeframe, typically 18-24 months.

Identifying and Negotiating with a Target Company

Once the SPAC is funded, the next step is to identify a target company to merge with or acquire. The search for a target company can span various industries and sectors, depending on the focus and expertise of the SPAC sponsors. When a potential target is identified, the SPAC and the target company enter into negotiations. The aim is to agree on the terms of the merger or acquisition. This process involves extensive due diligence to ensure that the target company is a viable candidate for going public.

Merging and Becoming Publicly Traded

If both parties agree to the terms, the SPAC uses the funds from the trust account to acquire the target company. This process is known as a de-SPAC transaction. Upon the successful completion of this transaction, the target company merges with the SPAC, effectively becoming a publicly traded entity. The shares of the combined entity are then listed on a stock exchange under a new ticker symbol.

SEC Reporting and Compliance

The entire SPAC process is subject to stringent regulatory oversight, particularly by the Securities and Exchange Commission (SEC). The SEC mandates rigorous financial reporting and disclosure requirements to protect investors and maintain market integrity. SPACs, like any other publicly traded entity, must comply with SEC reporting standards. This includes:

- Registration Statements: The SPAC must file a Form S-1 registration statement with the SEC to register its securities for the IPO. This document contains detailed information about the SPAC, its sponsors, and the terms of the offering.

- Periodic Reporting: After the IPO, the SPAC is required to file periodic reports, including Form 10-K (annual reports) and Form 10-Q (quarterly reports), which provide updates on the financial status and operations of the SPAC.

- Proxy Statements: When a target company is identified, the SPAC must file a proxy statement (Form 14A) with the SEC. This document is provided to shareholders to inform them about the proposed acquisition and to seek their approval for the transaction.

- 8-K Filings: Throughout the SPAC lifecycle, any material events, such as the announcement of a target acquisition or completion of the merger, must be disclosed via Form 8-K filings.

- Post-Merger Reporting: Once the merger is completed, the new public company must continue to comply with all SEC reporting requirements, including the submission of annual and quarterly reports, and maintaining transparency with shareholders.

The SPAC Process: Step-by-Step

- Formation and Fundraising: The SPAC is formed by sponsors who have expertise in specific industries or sectors. These sponsors take the SPAC public by conducting an IPO, selling units (usually a share of common stock and a fraction of a warrant) to investors. The capital raised is deposited into a trust account.

- Searching for a Target: After the IPO, the SPAC begins the search for a target company. This phase can involve extensive due diligence and negotiations to ensure the target is a viable candidate for going public.

- Negotiation and Merger: Once a target company is identified, the SPAC and the target negotiate the terms of the merger or acquisition. If an agreement is reached, the SPAC uses the funds from the trust account to acquire the target company, resulting in the target becoming a publicly traded entity. This process, known as a de-SPAC transaction, is often faster and less expensive than a traditional IPO.

SPACs offer an expedited path for private companies to enter public markets, bypassing the lengthy and complex traditional IPO process. However, this route is not without its challenges, particularly in terms of regulatory compliance and investor scrutiny. As SPACs continue to evolve, their role in the financial markets remains a topic of significant interest and discussion.

Publicly traded SPACs

A private company’s management is its everything. The magnitude of control the management wields on its operations is immense. But raising funds from investors is an arduous task. To access funds from regular investors, the general public, firms go public by offering stock shares at a certain price. As a result, these firms often have more capital to work with. However, publicly traded companies are subjected to regulatory scrutiny and disclosure requirements.

Thus, Immediately after a target company is identified and agrees to a merger, the operating company becomes a publicly traded company. The operating company can now raise capital through secondary offerings, and its shares can be sold on public exchanges. The SPAC’s investors can then decide to redeem their shares for cash or continue to hold their stakes in the newly merged company.

DataTracks provides regulatory reporting solutions that help prepare accurate compliance reports in iXBRL formats and HTML and XBRL to file with the SEC. DataTracks’ services allow for seamless filing with the SEC. DataTracks also provides Fully Managed Services catering to end-to-end filing necessities. All you need to do is share the finalized data that will be formatted and tagged to suit the requirements of the compliance guidelines.

FAQs on SPACs

What is a SPAC and how does it differ from a traditional IPO?

A Special Purpose Acquisition Company (SPAC) is a shell corporation that raises capital through an Initial Public Offering (IPO) with the sole purpose of acquiring an existing private company. Unlike traditional IPOs, where a private company directly offers its shares to the public, a SPAC allows the private company to become public through a merger with the SPAC, often providing a quicker and less costly route to going public.

How does the SPAC process ensure investor protection?

Investor protection in the SPAC process is ensured through various regulatory measures and safeguards:

- Funds raised in the SPAC IPO are placed in a trust account and can only be used for an acquisition or returned to investors if no acquisition occurs within a set timeframe.

- Extensive due diligence is conducted on potential target companies.

- The Securities and Exchange Commission (SEC) requires rigorous financial reporting and disclosure, including periodic filings and proxy statements, ensuring transparency and compliance.

What are the SEC reporting requirements for SPACs?

SPACs must comply with several SEC reporting requirements:

- Form S-1: Filed during the IPO to register securities, detailing the SPAC’s structure and terms.

- Periodic Reports: Form 10-K (annual) and Form 10-Q (quarterly) to update on financial status and operations.

- Proxy Statements: Form 14A to seek shareholder approval for proposed acquisitions.

- Form 8-K: To disclose material events, such as target acquisitions or merger completions.

- Post-Merger Reporting: Continuous compliance with all SEC reporting requirements for the new public company.

What happens if a SPAC does not complete an acquisition within the specified timeframe?

If a SPAC fails to complete an acquisition within the specified timeframe (usually 18-24 months), the funds held in the trust account are returned to investors. This provision ensures that investors do not lose their capital if the SPAC is unable to identify or finalize a suitable acquisition.

What are the benefits and risks associated with investing in a SPAC?

Benefits:

- Potential for high returns if the SPAC successfully merges with a high-growth target company.

- Access to investment opportunities typically reserved for private equity or institutional investors.

Risks:

- Uncertainty: Investors initially invest without knowing the target company.

- Potential for misalignment of interests between SPAC sponsors and public investors.

- Regulatory and market risks associated with the target company and the broader financial environment.