Understanding AOC-4 & MGT-7 Filings

When it comes to corporate governance and regulatory compliance, Forms AOC-4 and MGT-7/MGT-7A are essential documents for businesses in India. These documents are essential for the yearly documentation and financial reporting process, emphasizing transparency and responsibility in the business sector. Let’s delve deeper into the intricacies and procedures of these crucial forms.

All You Need to Know About Form AOC-4

Form AOC-4 epitomises the importance of financial transparency and responsibility in the Indian corporate world. It serves as a conduit for communicating the financial status and results of companies over the fiscal year, keeping stakeholders well-informed.

According to Section 137(1) of the Companies Act, 2013, all companies must submit their financial statements, along with consolidated statements and approved documents from the annual general meeting (AGM), to the Registrar within thirty days after the AGM. This submission, outlined in Section 403, includes specific procedures, fees, and possible extra charges for late filings.

Essentially, the definition of a “financial year” according to Subsection (41) of Section 2 highlights the timeframe concluding on March 31st annually, with a modification for companies established after January 1st, prolonging the duration to March 31st of the subsequent year. Ensuring a consistent reporting period across all entities.

According to Rule 12 of the Companies (Accounts) Rules, 2014, it is mandatory to electronically submit financial statements using e-Form AOC-4. Consolidated financial statements require the use of e-Form AOC-4 CFS. Furthermore, to improve reporting quality and accessibility, specific types of companies must submit their statements in the XBRL format, which is a global standard for exchanging business information.

All listed companies, their subsidiaries, companies with a paid-up capital of Rs. 5 crore or more, companies with a turnover of Rs. 100 crore or more, among others specified under the (Filing of Documents & Forms in Extensible Business Reporting Language) Rules, 2011, must comply with this requirement. Submission can be made through either AOC-4 or AOC-4 CFS forms, depending on the specific circumstances.

When submitting Form AOC-4, it is important to include various attachments, such as:

- Certified copies of the financial statements in accordance with Section 134, including the Board’s report, auditors’ report, and other relevant documents.

- Prepare Form AOC-1 for subsidiary statements as mandated by Section 129.

- Reasons for not approving financial statements during the AGM.

- Letters of approval for extending the financial year or AGM.

- Preparing audit reports in accordance with Section 143, and following the CSR policy specified in Section 135(4).

- Prepare Form AOC-2 outlining contracts, arrangements, or transactions with related parties as per Section 188(1).

- Directors’ report in accordance with Section 134(3), and information on CSR initiatives.

In addition, those responsible need to confirm the authorization for form submission by examining the minutes book of the Board Meeting and ensuring that a copy of the resolution granting authority to the designated individual (Director/Manager/CEO/CFO) is included. This meticulous method of filing establishes a strong foundation for corporate governance, strengthening transparency and accountability in India’s business environment.

Overview of Form AOC-4 Filing Requirements

Form AOC-4 is crucial for companies in India as it is used to file annual financial statements with the Registrar of Companies (ROC). Companies that have a subsidiary, associate, or joint venture need to prepare two types of financial statements:

Standalone Financial Statements

- These documents detail the financial activities of the parent company alone and are essential for assessing its individual performance.

Consolidated Financial Statements (CFS)

- Filed using Form AOC-4 CFS, these include data from both the parent company and its subsidiaries or associates, providing a comprehensive view of the corporate group’s financial health.

Additional Reporting Requirements

- Alongside the CFS, companies must attach Form AOC-1, which highlights key aspects of the financial statements from subsidiaries or associates.

Definitions of Companies and Examples

- Parent/Holding Company: Controls subsidiaries typically through voting power or board composition.

- Example: ABC Limited owns 75% voting power of XYZ Limited, making it the holding company.

- Subsidiary Company: Controlled by another company via board dominance or majority voting power.

- Associate Company: Significant influence (at least 20% voting power) but not full control.

- Example: ABC Limited holds 25% of PQR Limited, classifying it as an associate company.

Special Provisions for NBFCs and XBRL Filings

Form AOC-4 for NBFCs

Non-Banking Financial Companies (NBFCs) that comply with Indian Accounting Standards are required to file their financial statements using either Form AOC-4 NBFC (Ind AS) for individual reports or Form AOC-4 CFS NBFC (Ind AS) for consolidated reports. Learn more about the specifics for NBFCs in our detailed article on XBRL Returns for NBFCs.

Form AOC-4 XBRL Requirements

- Extensible Business Reporting Language (XBRL) is used globally to streamline the business and financial information exchange. Various software tools are available for preparing XBRL documents.

Mandatory XBRL Filing

- As per the 2014 Companies (Accounts) Rules, certain classes of companies must file their statements in XBRL format using Form AOC-4 XBRL:

- Listed companies and their Indian subsidiaries.

- Companies with a paid-up capital of ₹5 crores or more.

- Companies with annual turnover of ₹100 crores or more.

- Entities required to comply with the Companies (Ind AS) Rules, 2015.

XBRL Filing Due Date and Deadlines

AOC-4 and AOC-4 CFS Filing Overview

Under Section 137 of the Companies Act, 2013, companies in India are required to file their annual financial statements using Form AOC-4. For those entities that need to submit consolidated financial statements, Form AOC-4 CFS is used.

AOC-4 XBRL Due Date

The general deadline for filing these forms is 30 days from the conclusion of the AGM (Annual General Meeting). This deadline ensures that companies prepare and submit their financial disclosures in a timely manner, maintaining compliance with regulatory requirements.

XBRL Filing Deadline

For a One Person Company (OPC), the rules are slightly different. The due date for OPCs to file their annual accounts is extended to 180 days from the close of the financial year. This provides OPCs with a longer period to prepare their financial statements compared to other types of companies.

Specific Deadlines to AOC-4 XBRL filing for FY2023-2024:

-

- For most companies, the final filing date for the fiscal year ending on 31st March 2024 would be 29th October 2024.

- For One Person Companies, this deadline is 27th September 2024, reflecting the extended period granted to them.

By adhering to these deadlines, companies can avoid penalties and ensure their financial operations remain transparent and under regulatory compliance.

Everything You Need to Know About MGT-7/MGT-7A

Form MGT-7/MGT-7A serves as a detailed disclosure mechanism for companies in India, emphasising non-financial information crucial for grasping a company’s governance, ownership, and organisational structure. Often described as the “Annual Return,” this document summarises a company’s shareholder makeup, directorship, capital structure, and important governance actions during the previous financial year. Unlike financial statements, which provide a breakdown of the company’s financial performance. The annual report offers stakeholders a comprehensive overview of the company’s activities, financial structure, ownership details, governance framework, executive compensations, and other important non-financial elements at the end of the fiscal year.

One of the key aspects of corporate compliance is the Annual Return, which requires certification from a practicing company secretary for listed companies or those with a paid-up capital exceeding 10 crore rupees or turnover over 50 crore rupees, as outlined in Form No. MGT-8. Ensure the submission is done within sixty days from the Annual General Meeting (AGM) date, with an option for a 270-day extension period available for an extra charge. Not meeting these deadlines leads to default, highlighting the significance of timely compliance.

The Annual Return contains a wide range of information, including:

- Details about the company’s registered office, primary business activities, and its holding, subsidiary, and associate companies.

- Providing information on the shareholding structure, as well as stocks, debentures, and other securities.

- Financial obligations.

- Compensation for directors and key managerial personnel.

- Discussing penalties or sanctions against the company, its directors, or officers, along with details on compounding offences and appeals.

- Ensuring adherence to regulations and providing transparency through certifications.

- Provide information about foreign institutional investors, such as their ownership percentages.

- Modifications in membership and debenture holders.

- Updates regarding promoters, directors, and key managerial personnel.

- Keeping track of member and board meetings, along with attendance information.

- Any Additional required details.

MGT 7 Due Date

Filing Annual Returns with Form MGT-7 and MGT-7A

Under Section 92 of the Companies Act, 2013, Indian companies are obligated to file their annual returns using Form MGT-7 for most companies, and Form MGT-7A for One Person Companies (OPCs) and small companies. This filing reflects the company’s activities and financial status over the fiscal year.

MGT 7 Filing Deadline for Fiscal Year 2023-2024

The statutory deadline for submitting these forms is 60 days from the conclusion of the AGM (Annual General Meeting). For companies whose fiscal year ends on 31st March 2024, they must adhere to this timeline to ensure compliance.

Specific Deadline for Annual Returns

The MGT 7 due date is the earlier of the two: the 60-day period post-AGM or the fixed cutoff date of 28th November 2024. This means if the 60-day period after the AGM exceeds this date, the filing should be completed no later than November 28th.

Practical Example:

-

- If a company’s AGM is held on 30th September 2024, the 60-day deadline would normally fall on 29th November 2024. However, due to the “whichever is earlier” rule, the MGT 7 filing must be done by 28th November 2024.

Sticking to the MGT 7 due date not only fulfills legal obligations but also enhances transparency and integrity in the company’s financial reporting, crucial for maintaining trust with stakeholders and regulatory bodies.

Conclusion

In wrapping up, mastering the complexities of AOC-4 and MGT-7 filings is paramount for upholding compliance and reinforcing corporate integrity. Simplifying this intricate process becomes seamless with the expertise of DataTracks, a leader in facilitating iXBRL preparations for your financial disclosures.

DataTracks – Top iXBRL service provider in India, excels in ensuring your documents meet the stringent requirements set forth, guaranteeing precision, adherence to regulatory mandates, and punctuality in submissions. Entrusting this aspect of your financial and annual reporting to DataTracks not only streamlines your compliance journey but also empowers your business to concentrate on its primary goals, all while maintaining the highest standards of corporate governance.

Frequently Asked Questions on AOC-4 and MGT-7

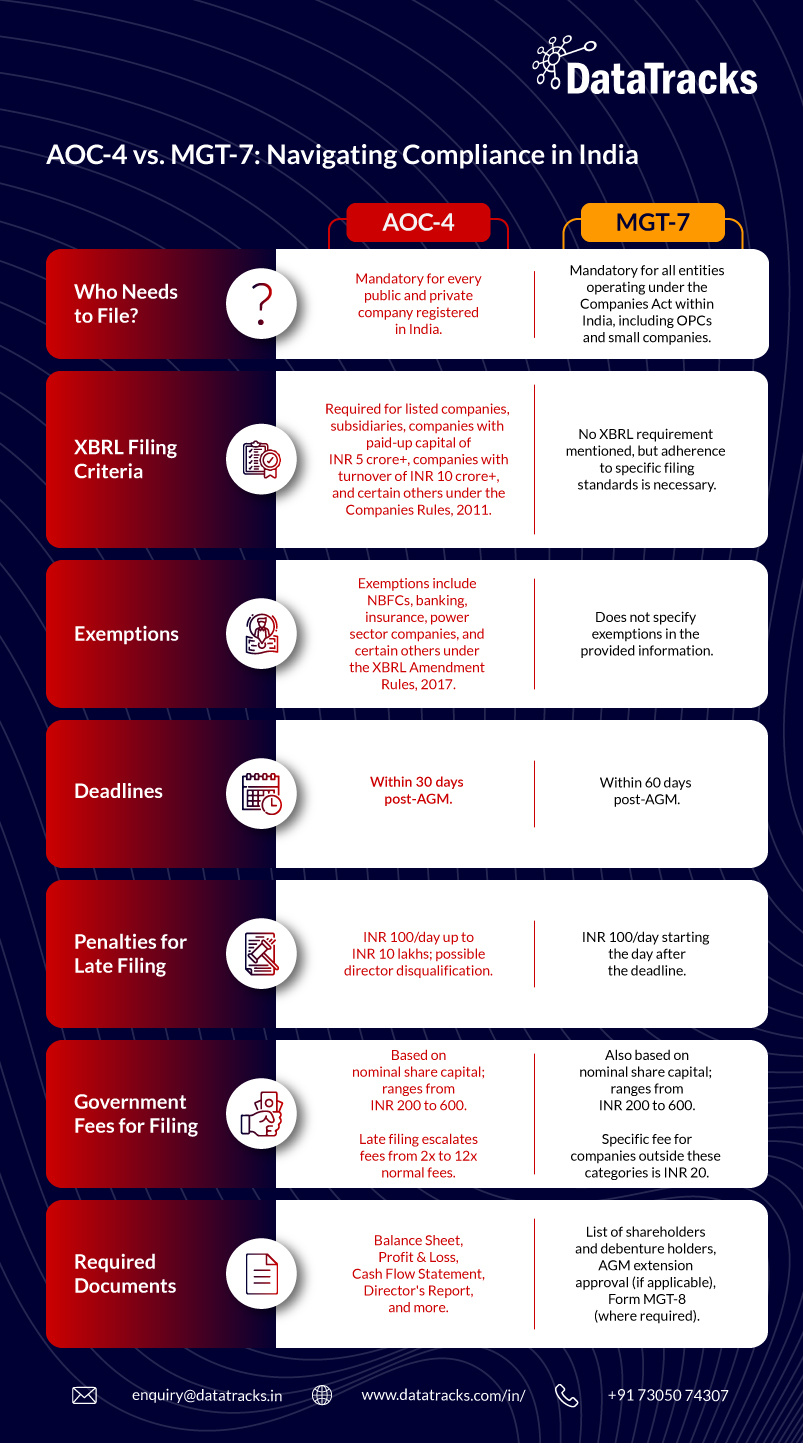

Who is required to file e-Form AOC-4?

Every public and private company registered in India must file e-Form AOC-4.

What are the criteria for companies to file their financial statements in XBRL format?

Financial statements must be filed in XBRL format by:

- Listed companies and their subsidiaries in India.

- Companies with paid-up capital of INR 5 crore or more.

- Companies with an annual turnover of INR 10 crore or more.

- Companies governed under the Companies Rules, 2011, which require XBRL filings.

Are there any exemptions from filing financial statements in XBRL format with Form AOC-4?

Yes, exemptions include:

- Non-Banking Financial Companies, Banking, Insurance, and Power sector companies.

- NBFCs must file AOC-4 NBFC, introduced on February 20, 2020.

- Companies specified under the XBRL Amendment Rules, 2017.

What is the deadline for filing Form AOC-4?

Form AOC-4 must be filed within 30 days from the date of the company’s Annual General Meeting (AGM).

Is there an extension for filing AOC-4 NBFC (Ind AS) & AOC-4 CFS NBFC (Ind AS) forms?

Yes. The Ministry of Corporate Affairs (MCA) has extended the due date for filing AOC-4, AOC-4 (CFS), AOC-4 XBRL, and AOC-4 Non-XBRL forms. For the financial year 2023-24:

- OPC: Due date is September 27th, 2024.

- Other Companies: Due date is October 29th, 2024.

There is also an extension of up to November 28th, 2024 within 60 days of the AGM for forms like MGT 7/MGT 7-A.

What penalties are imposed for late or non-filing of Form AOC-4?

A penalty of INR 100 per day is charged from the due date, with a maximum penalty cap of INR 10 lakhs. Non-compliance for three consecutive years may result in director disqualification, imprisonment, or fines ranging from INR 1 to 5 lakhs for key managerial personnel.

How does the government fee escalate for late filing of Form AOC-4?

The escalation of government fees for late filing is as follows:

- Up to 30 Days: 2x normal fees.

- 31 to 60 Days: 4x normal fees.

- 61 to 90 Days: 6x normal fees.

- 91 to 120 Days: 8x normal fees.

- 121 to 180 Days: 10x normal fees.

- 181 to 270 Days: 12x normal fees.

What is the government fee for timely filing AOC-4?

The fee structure is based on the company’s nominal share capital:

- Up to INR 1 lakh or no nominal share capital: INR 200.

- INR 1 lakh to INR 5 lakhs: INR 300.

- INR 5 lakhs to INR 25 lakhs: INR 400.

- INR 25 lakhs to INR 1 crore: INR 500.

- More than INR 1 crore: INR 600.

Who is required to file Form MGT-7?

All entities registered under the Companies Act operating within India, including One Person Companies (OPCs) and small companies, are mandated to file Form MGT-7.

What are the filing fees for Form MGT-7?

The filing fees for Form MGT-7 vary based on the company’s nominal share capital, as outlined below:

- Nominal Share Capital less than INR 1,00,000: INR 200

- Nominal Share Capital between INR 1,00,000 and INR 4,99,999: INR 300

- Nominal Share Capital between INR 5,00,000 and INR 24,99,999: INR 400

- Nominal Share Capital between INR 25,00,000 and INR 99,99,999: INR 500

- Nominal Share Capital INR 1,00,00,000 or more: INR 600

For companies that do not fall under these categories, the fee for filing MGT-7 is INR 20.

What is the penalty for late filing of Form MGT-7?

In accordance with the Companies (Registration Offices and Fees) Second Amendment Rules 2018, the penalty for late filing of Form MGT-7 is INR 100 per day of delay, starting from the day after the filing deadline. In Recent, The Ministry of Corporate Affairs (MCA) levied a hefty fine of ₹40 lakhs on a company for failing to submit MGT-07 and AOC-04 forms within the stipulated deadlines.

What documents are required to be filed along with Form MGT-7?

The following documents must be submitted alongside Form MGT-7:

- A list detailing the names and information of all shareholders and debenture holders, applicable to companies with share capital and where a complete list has been attached.

- Approval letter for the extension of the Annual General Meeting (AGM), if applicable.

- Form MGT-8, where required.

Is Form MGT-8 always required when filing Form MGT-7?

Form MGT-8 is optional and only necessary under certain conditions: it is required for companies that are listed or have a paid-up share capital of INR 10 Crores or more, or those with a turnover of INR 50 Crores or more. Form MGT-8 serves as a certification by a practicing Company Secretary.