Ind AS vs. Indian GAAP: What are the key differences?

India is trying to move to the Indian IFRS accounting standards popularly known as Ind AS. This move will not be easy considering that Ind AS is rather different from the current Indian GAAP standards. Here are some highlights in the differences between the two standards that are bound to make the migration challenging.

Objectives of Indian Accounting Standards (Ind AS):

- Transparency and Consistency: IND AS ensures all companies in India report their finances in a clear, consistent way, making it easy to understand their performance.

- Comparability: Financial statements prepared using IND AS are comparable across different companies, allowing investors and analysts to easily compare the financial health of various businesses.

- Global Alignment: IND AS follows international best practices, making Indian companies’ financial statements understandable to foreign investors and stakeholders.

- High-Quality Information: By following IND AS, companies provide investors and other interested parties with reliable and accurate financial information.

In essence, IND AS aims to create a level playing field for financial reporting in India, fostering trust and facilitating better investment decisions.

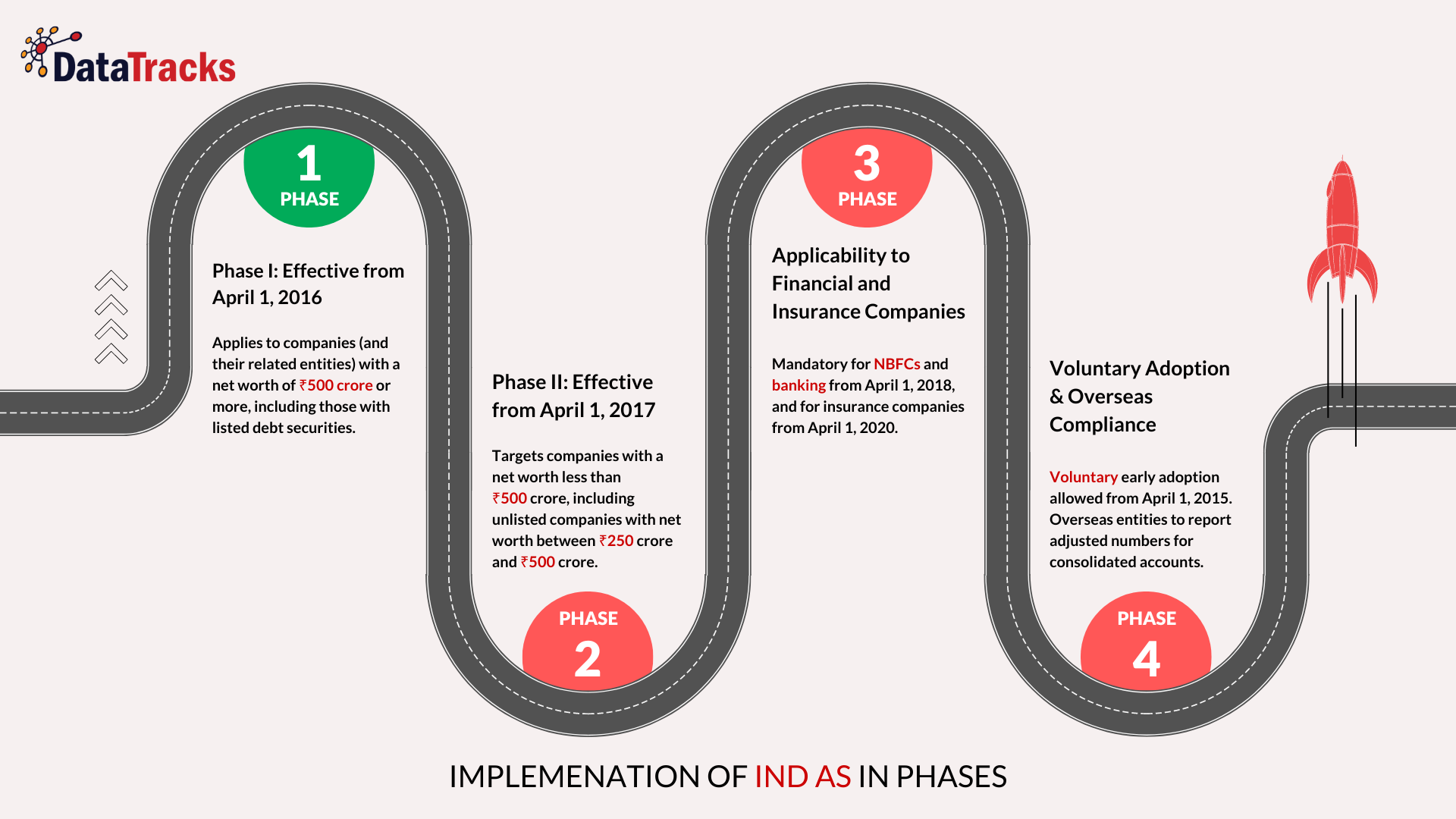

Phased Implementation Schedule for Indian Accounting Standards (Ind AS)

The implementation of Indian Accounting Standards (Ind AS) is structured in several phases to facilitate a smooth transition for different categories of companies:

Phase I: Starting April 1, 2016, Ind AS is mandatory for companies with a net worth of ₹500 crore or more, including those with debt securities listed or in the process of being listed in India or abroad. This also applies to their holding, subsidiary, joint venture, or associate companies.

Phase II: From April 1, 2017, the requirement extends to companies with a net worth of less than ₹500 crore if they have securities listed or are in the process of being listed in India or outside India, and to unlisted companies with a net worth of more than ₹250 crore but less than ₹500 crore, along with their holding, subsidiary, joint venture, or associate companies.

Applicability to Financial and Insurance Companies: Ind AS will apply to banking and non-banking finance companies (NBFCs) starting April 1, 2018, and to insurance companies from April 1, 2020.

Voluntary Adoption: Companies are allowed to voluntarily adopt Ind AS for accounting periods beginning on or after April 1, 2015. However, once they choose to report under Ind AS, reverting to the previous Indian GAAP is not permitted.

Overseas Subsidiaries: Overseas subsidiaries, associates, or joint ventures of Indian companies are not required to prepare their standalone financial statements according to Ind AS. They may follow their local jurisdictional requirements but must report Ind AS adjusted numbers for the purpose of preparing consolidated Ind AS accounts by their Indian parent company.

Navigating New Standards – India’s Shift from IGAAP to Ind AS

In recent years, India has embarked on a significant overhaul of its accounting standards, transitioning from Indian GAAP to Ind AS. This move is designed to align Indian accounting with global practices, notably the International Financial Reporting Standards (IFRS). The goal? To enhance transparency and allow financial statements to be easily compared on a global scale.

Why the Change?

The adoption of Ind AS marks a pivotal change in how financial information is reported in India. This shift brings a higher level of clarity to financial statements, offering stakeholders a more detailed view of a company’s financial health. For international investors, the change means easier access to comprehensible and comparable financial data, making Indian companies more attractive investment opportunities.

What’s New with Ind AS over IGAAP?

- Transparency and Clarity: Ind AS introduces stringent disclosure requirements and valuation techniques, such as fair value measurement, which provide a clearer picture of a company’s financial status.

- Global Investment Appeal: With Ind AS, Indian corporate financial statements become easier for global investors to understand, boosting their confidence in Indian markets.

- Detailed Reporting: The new standards require a detailed breakdown of financial data, including specific revenue recognition and the impact of currency fluctuations, which are crucial for businesses operating in international markets.

Impact on Business Operations

- Smoother Consolidation: Companies with international branches find it easier to consolidate their financials under Ind AS, as the standards are similar to those used worldwide.

- Enhanced Governance: A stronger regulatory framework under Ind AS means improved governance and risk management across companies.

Observing the Changes: Statistics and Real-World Effects

Since 2015, thousands of Indian companies have made the switch to Ind AS, with larger corporations leading the way. This phased approach has helped companies adjust smoothly to the new standards.

- Economic Impact: Companies reported noticeable shifts in asset and liability valuation, with some sectors experiencing more than a 30% change in reported earnings due to new valuation and depreciation methods.

- Market Adjustments: Initially, the transition led to some volatility in stock prices, but the market has since stabilized as stakeholders have adjusted to the new reporting norms.

- Cost Implications: Initially higher audit and compliance costs are expected to decrease over time as the standards become more ingrained in everyday business practices.

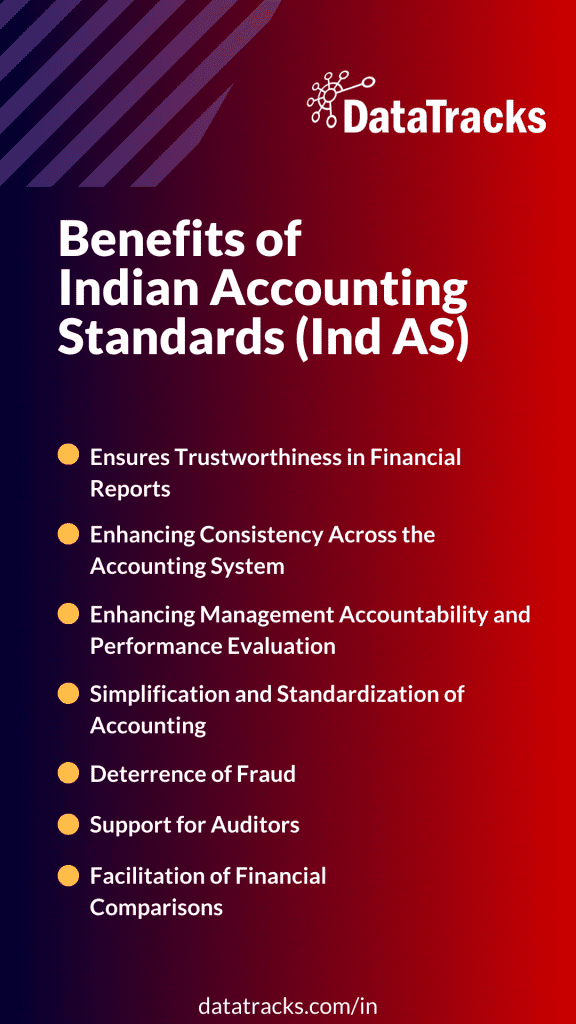

Benefits of Indian Accounting Standards (Ind AS)

Ensures Trustworthiness in Financial Reports

Financial reports are the backbone of transparency and trust between businesses and their stakeholders. Investors, along with other key players, lean heavily on the insights gleaned from these reports to navigate their decision-making processes. It’s not just about the numbers; it’s about the story they tell and the future they hint at.

Accuracy and transparency aren’t just beneficial; they’re essential. That’s where Ind AS steps in, setting the stage for financial documents to be not just seen but believed. Through the meticulous standards set by Ind AS, financial reports transform into beacons of trust, guiding stakeholders through their decision-making journeys with confidence. The adoption of Ind AS doesn’t just elevate the credibility of these reports; it reaffirms their pivotal role in shaping informed decisions.

Enhancing Consistency Across the Accounting System

One of the primary advantages of implementing accounting standards, including Indian Accounting Standards (Ind AS), is the establishment of uniformity across the entire accounting landscape.

Consistency is a key advantage of following well-established accounting principles. Ind AS ensures that all organisations document their transactions in a consistent manner by setting identical criteria and rules for managing accounting transactions.

Consider, for instance, the way Ind AS addresses the nuances of depreciation. By mandating a universal standard like AS-6 for depreciation matters, it ensures that all organizations are on the same page, thus elevating the integrity and comparability of financial reporting. This uniform approach doesn’t just benefit individual entities; it enriches the entire financial ecosystem, promoting a standardized accounting system that resonates on both a national and global scale. In doing so, Ind AS doesn’t just advocate for uniformity; it champions the clarity and trust that come with it, paving the way for a more transparent, accountable, and ultimately, a more trustworthy business world.

Enhancing Management Accountability and Performance Evaluation

Indian Accounting Standards (Ind AS) facilitate the precise assessment of management’s accountability. They simplify the evaluation of the management team’s performance, allowing for constructive feedback.

Ind AS helps in evaluating how well the management is maintaining the company’s solvency, improving profitability, and fulfilling other important responsibilities. In addition, it guides management in following precise accounting standards and policies, guaranteeing uniformity and transparency in financial reporting.

Simplification and Standardization of Accounting

A significant advantage of Ind AS is the simplification and standardization it brings to the accounting process. By providing clear guidelines for every accounting transaction, it removes complexity, ensuring a standard and uniform process. This uniformity aids users in understanding financial information easily and reduces the risk of misinterpretation.

Deterrence of Fraud

Indian Accounting Standards are essential for maintaining the integrity of the accounting system and safeguarding against fraudulent activities. Through the implementation of rigorous accounting rules and principles, these standards effectively reduce the possibility of financial data manipulation and fraud, making it much more difficult for management to engage in deceitful activities or distort financial information.

Support for Auditors

Ind AS supports auditors by simplifying their tasks and enhancing the effectiveness of their audits. With established rules, guidelines, and principles, auditors can more easily verify that financial reports are accurate and comply with the required standards.

This ensures the financial statements are prepared and presented faithfully, aiding auditors in affirming the reliability and validity of the financial information.

Facilitation of Financial Comparisons

Accounting standards significantly improve the comparability of financial statements between different entities. Without a uniform accounting framework, comparing the financial statements of companies that use different accounting methods or formats would be challenging.

It can be challenging to compare companies that utilise different inventory accounting methods, such as LIFO and FIFO. Ind AS tackles these challenges by standardising accounting practices, simplifying the comparison of financial information across different entities.

Impact of Ind AS Adoption on Financial Reporting and Valuation

The transition to Indian Accounting Standards (Ind AS) has significantly altered the financial reporting landscape, emphasizing fair valuation over traditional historical cost valuation and prioritizing the substance over the legal form of transactions.

An audit analysis revealed notable effects on the Profit after Tax, Property, Plant, and Equipment, Financial Investments, and Net Worth of selected Central Public Sector Enterprises (CPSEs) due to the adoption of Ind AS.

Additionally, the new revenue recognition methods under Ind AS have affected the reported revenues of CPSEs that implemented these standards. These modifications, documented in the CPSEs’ financial statements for the year ending 31 March 2017, are crucial for accurately assessing the performance and financial standing of these enterprises.

For detailed insights, refer to the full report.

Difference Between IND AS and Indian GAAP

IND AS (Indian Accounting Standards) and Indian GAAP (Generally Accepted Accounting Principles) are two accounting frameworks used in India, but with some key differences:

Taxonomy

Generally, the Indian GAAP taxonomy has an estimation of 2500 elements. This is a small figure compared to the Ind AS element count of 6800.

Scope of Tagging

Indian GAAP requires only 300 mandatory elements to be tagged. Under IGAAP, the accounting treatment of acquisition varies widely depending on the legal structure which affects the reported amount of goodwill. This is entirely different with Ind AS. This is because the MCA has expanded the scope of tagging where there are no minimum tagging requirements. Under Ind AS, it is not relevant whether an acquisition is a legal entity or even a group asset as long as it is an acquired asset.

Validation

In the interest of data transparency, there are more elaborate disclosures by corporations to the MCA in the Ind AS taxonomy than there are in Indian GAAP. In fact, in INGAAP additional disclosures such as rate reconciliation, tax holidays and even joint ventures are not required. In IND AS however, the MCA validation tool validates more than 800 mandatory fields of information. This ensures accountable disclosures while also increasing the complexity of tagging.

Records

Unique records such as DIN/PAN/CIN/SRN are a necessary provision in the case of Ind AS. Dummy records are unacceptable with all records being centralised. This makes validation more robust considering there is an interlinking of different government databases. This is different in the case of INGAAP with dummy records being acceptable without the requisite need of providing unique records.

Why is outsourcing a better option at this stage?

There are various benefits that come with outsourcing the audit process at this stage. Outsourcing ensures an in-depth analysis of the operations and their compliance with both Ind AS and Indian GAAP by the service provider. They also ensure an unbiased appraisal, which is essential in generating new ideas and proposals for better performance. External auditors also reduce the costs of auditing. The certified consultants are skilled enough and do not require training fixed salary, thus saving costs and resources hugely.

Clearly, Ind AS is vastly different from Indian GAAP. These differences make the switch a daunting task. However, it’s essential to note that in case of cost audits, it is mandatory to tag the product headings as per the Central Excise Act with other relevant information such as net worth, net revenue as per cost books. This demonstrates the necessity of outsourcing the cost auditing to a certified consultants who have demonstrable knowledge of all the aspects involved. Therefore, guidance from knowledge experts is highly recommended at this transitional stage.

DataTracks: Streamlining Your XBRL Conversion and Tagging for IND AS Compliance

DataTracks offers a comprehensive solution for companies in India grappling with XBRL filing requirements under Indian Accounting Standards (Ind AS). Their services encompass:

- XBRL Conversion: DataTracks expertly converts your financial statements prepared according to Ind AS into the XBRL format, ensuring all data is accurately represented.

- IND AS Tagging: Our team precisely tags each data element within your XBRL document using the relevant Ind AS taxonomy. This guarantees your filings adhere to the specific disclosure requirements of Ind AS.

By outsourcing your XBRL conversion and tagging to DataTracks, you can achieve:

- Effortless Compliance: Meet MCA filing deadlines with confidence, knowing your XBRL submissions are error-free.

- Enhanced Accuracy: Their data validation processes minimize the risk of errors, ensuring the integrity of your financial data.

- Improved Efficiency: Free up your internal resources by delegating the XBRL conversion and tagging tasks to DataTracks’ experts.

DataTracks India empowers Indian companies to navigate the complexities of XBRL filing under Ind AS. Their efficient and accurate conversion and tagging services ensure a smooth and compliant regulatory reporting experience.

Frequently Asked Questions on IND AS

What is the new Ind-AS taxonomy?

The new Ind-AS taxonomy is a standardized way to electronically tag financial statements prepared according to Indian Accounting Standards (Ind-AS). It essentially acts as a classification system for financial data.

Who is required to use the new Ind-AS taxonomy?

Companies that prepare their financial statements for accounting years beginning on or after April 1, 2015, are required to use the new Ind-AS taxonomy when filing their XBRL documents. XBRL stands for Extensible Business Reporting Language, a format for electronically tagging financial data.

What are the benefits of using the new Ind-AS taxonomy?

- Standardization: It ensures consistency in how financial data is presented, making it easier to compare financial statements from different companies.

- Efficiency: Electronic tagging simplifies filing and analysis of financial data.

- Transparency: It promotes better financial transparency for investors and other stakeholders.

What are the main differences between the Ind AS taxonomy and the C&I taxonomy?

The Ind AS taxonomy reflects the adoption of Indian Accounting Standards (Ind AS) issued by the ICAI. Here’s a breakdown of the key changes:

- Alignment with Ind AS: The Ind AS taxonomy follows the requirements of the new accounting standards, leading to more detailed and comprehensive financial disclosures.

- Additional Disclosures: The new taxonomy incorporates mandatory reporting of additional information not required under C&I.

- Increased Elements: The structure of the taxonomy has expanded significantly with a roughly 64% rise in the number of elements. This allows for capturing more granular financial data.

- Improved Structure: The taxonomy utilizes more tables and residual elements for better organization and data capture.

- Enhanced Validation: Formula linkbases ensure consistency by validating relationships between monetary elements. For example, the sum of opening balance and changes during the year must match the ending balance.

- Dimensional Reporting: The Ind AS taxonomy uses “dimensions” instead of “tuples” for a more flexible approach to categorizing financial data.

Why were these changes made?

A: The shift to the Ind AS taxonomy brings Indian financial reporting practices closer to international standards (IFRS). This promotes transparency, facilitates comparisons between companies, and enhances the usefulness of financial statements for stakeholders.

Who is required to use the Ind AS taxonomy?

A: Companies that prepare their financial statements for accounting years beginning on or after April 1, 2015, must use the Ind AS taxonomy for filing their XBRL documents (electronic tagging of financial data)