Extension of time for holding AGM for Financial Year 2020-21

Every company registered with the Ministry of Corporate Affairs (MCA) in India, other than a one-person company, must hold an Annual General Meeting (AGM) each year according to Section 96 of Companies Act, 2013. AGM rules require companies to ensure that AGM is completed within six months from the end of the financial year and that the gap between AGMs of 2 consecutive years is not more than 15 months.

The pandemic, however, hasn’t allowed companies to function smoothly or hold AGM within due dates. Despite relaxations offered by MCA to companies to conduct AGMs and board meetings virtually, challenges caused by Covid-19 are unique.

What is the time extended for holding AGM for FY 2020-21?

Given such challenges, companies, professional institutes, and industry bodies made representations to allow extension of time for conducting AGM for the year ended 31 March 2021.

Under the provisions of section 96(1) of Companies Act, 2013 (third provision), the MCA has directed all registrars to grant an extension of time to hold AGM for the year ended 31 March 2021 by a period of 2 months from the due date by which companies should have conducted their AGM.

It is worth noting that the third proviso to section 96(1) of Companies Act, 2013 grants power to the Registrar, for any particular reason, to extend the time within which any Annual General Meeting, other than the first Annual General Meeting, should be held, by a period not exceeding three months.

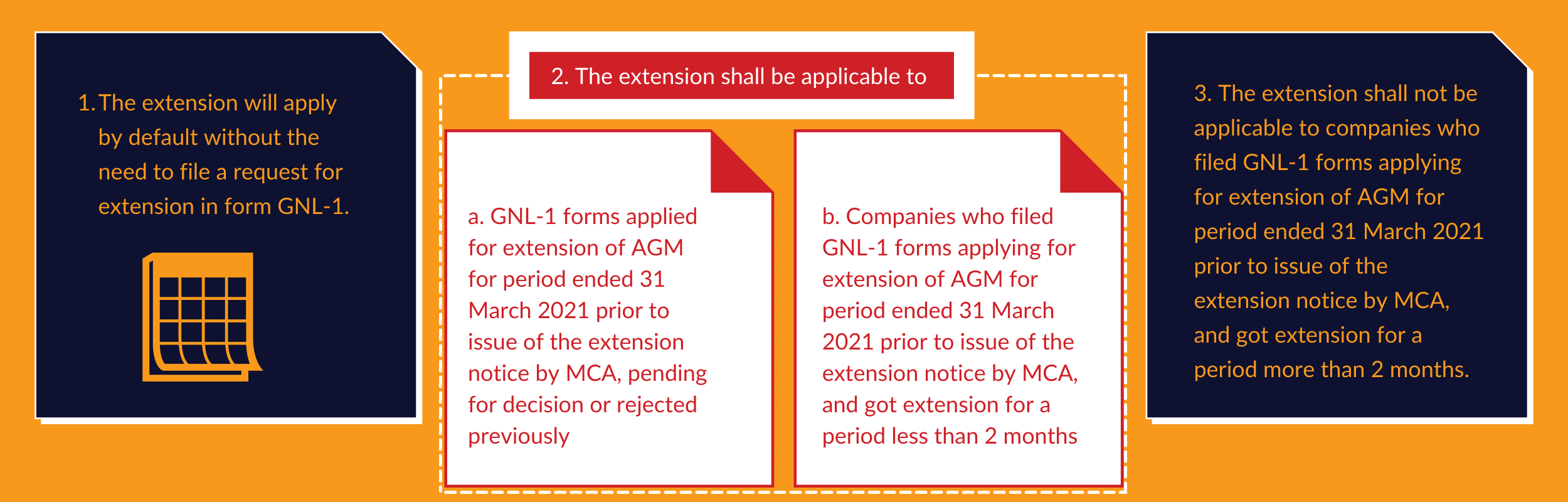

However, the ministry has also clarified the following points offering great clarity to companies.

These extensions should assist companies in staying compliant and avoiding penalties. We at DataTracks as well are here to help you with your compliance requirements.

We help over 200 companies in India and 20,000 clients across the globe with their regulatory reporting requirements. Compliance professionals (prepares, reviewers, audit teams, and other stakeholders) in India benefit from our AOC-4 XBRL and Cost Audit XBRL services.

If you need any assistance with your XBRL submissions, please drop a line to enquiry@datatracks.in . You can also connect with us on call +91 44 4208 1719.