Unlocking Global Compliance with DataTracks’ Expert FATCA Reporting Solutions

FATCA is a US regulation that requires FFIs (financial institutions) outside the US to report information about accounts held by US taxpayers to the US Internal Revenue Service (IRS).

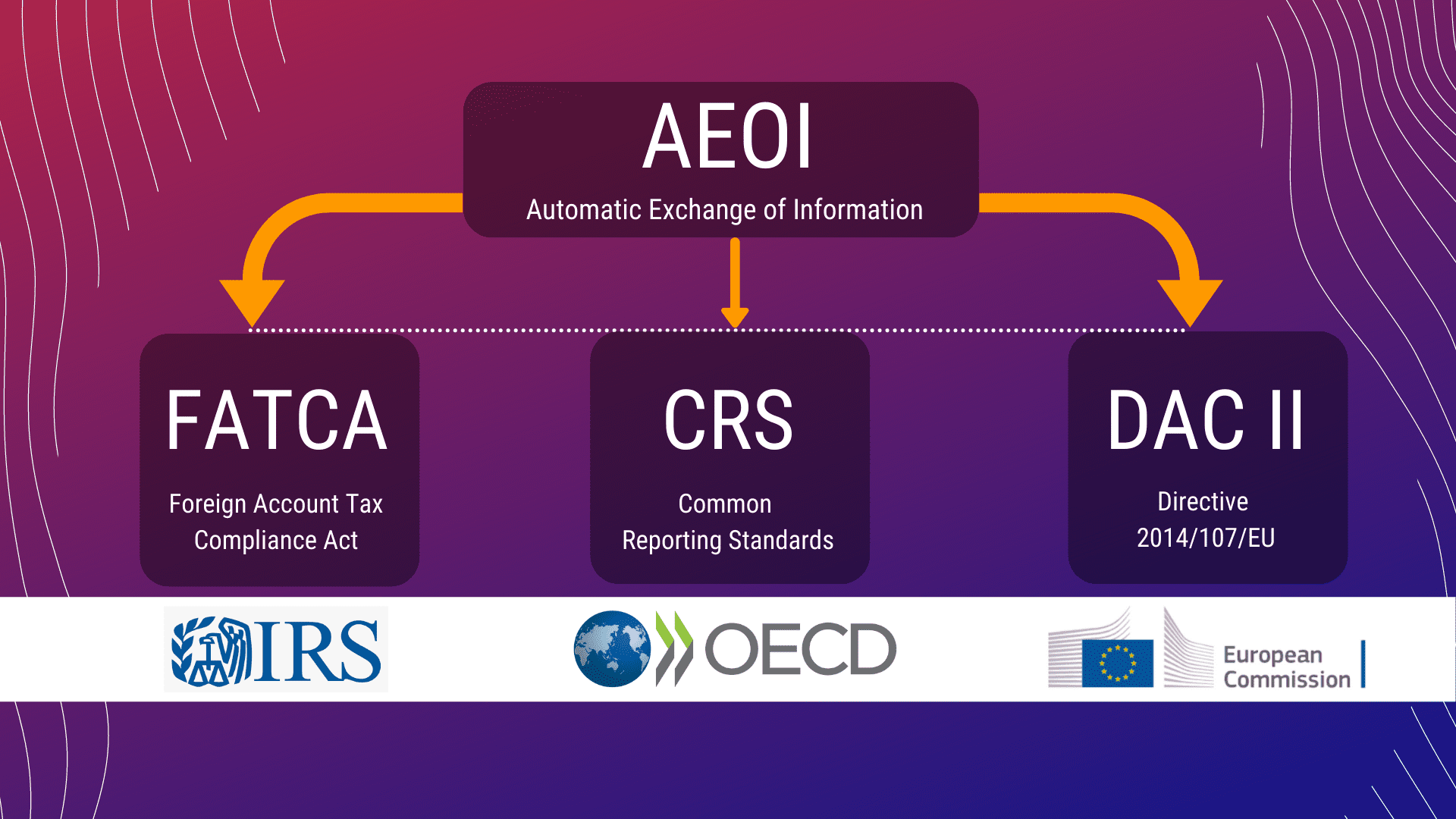

The Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) were created to fight tax evasion by requiring financial institutions to report on foreign account holders. This aims to improve transparency. Let’s explore how DataTracks provides FATCA Services for the global region.

Challenges of Global FATCA Compliance

The Foreign Account Tax Compliance Act (FATCA) is crucial in today’s interconnected financial world in ensuring tax transparency. However, for Foreign Financial Institutions (FFIs) operating globally, navigating the intricacies of FATCA compliance can be a minefield. Here’s a closer look at the key challenges FFIs face when it comes to FATCA:

- Report Issues: A few EU residents faced frozen accounts or difficulties opening new accounts due to financial institutions being wary of the complex FATCA reporting

- Data Aggregation: Consolidating customer information from various internal systems across different countries can be daunting.

- Account Identification: Accurately identifying reportable accounts under FATCA regulations requires meticulous screening.

Reporting Requirements: Formatting and transmitting FATCA reports according to specific country formats and deadlines can be error-prone.

Improvements Done

Recognizing these challenges, the OECD (Organisation for Economic Co-operation and Development) and the IRS (Internal Revenue Service) work together to create a more streamlined reporting system. These advancements aim to improve information sharing between the EU and other countries while reducing burdens on both financial institutions and foreign citizens.

DataTracks offers FATCA services to assist financial institutions (FFIs) globally comply with the regulations of the Foreign Account Tax Compliance Act (FATCA)

Quick Facts about FATCA

In this ever-evolving world of global finance, staying compliant with regulations can be challenging. One such regulation, the Foreign Account Tax Compliance Act (FATCA), significantly impacts financial institutions worldwide. Here are some quick facts to shed light on FATCA and its implications:

- Goals: FATCA aims to ensure taxpayers reveal their income and assets in offshore accounts, allowing tax authorities to identify potential fraud or discrepancies.

- Focus: Unlike FBAR (which only reports bank accounts), FATCA reporting is broader, encompassing bank accounts and other foreign assets like stocks, pensions, and insurance.

- Account Scope: FATCA targets offshore accounts held by US persons (citizens, residents, or green card holders).

- Reporting Institutions: Financial institutions like banks, investment entities, and insurance companies must report under FATCA.

- Information Reported: Details reported typically include the account holder’s name, address, tax ID, account number, and account balance.

DataTracks: Your Partner in FATCA Services

With DataTracks’ cutting-edge technology and expertise, we offer tailored solutions to streamline your FATCA reporting process, ensuring accuracy, efficiency, and compliance. DataTracks offers a robust FATCA reporting services solution that addresses these challenges and streamlines compliance.

Here’s how:

- Automated Data Collection: DataTracks integrates seamlessly with your existing systems, automatically collecting and aggregating customer data relevant for FATCA reporting.

- Efficient Account Identification: DataTracks leverages advanced algorithms and pre-defined rules to pinpoint accounts that meet FATCA reporting criteria, saving you valuable time and resources.

- Streamlined Report Generation: One can generate FATCA reports effortlessly with DataTracks’ pre-built templates that comply with various country-specific formats.

Error Detection and Validation: DataTracks’ built-in validation engine meticulously checks your reports for errors before submission, ensuring accuracy and reducing the risk of rejection.

Benefits of DataTracks for FATCA Services:

Ensuring meticulous FATCA compliance can be a significant burden, requiring vast resources and meticulous attention to detail. DataTracks benefits you by:

- Reduced Costs: Streamlining your FATCA processes can minimize your manual effort, thus significantly saving costs.

- Improved Accuracy: Automated data gathering and error detection ensure the accuracy of your FATCA reports.

- Enhanced Efficiency: Meet FATCA deadlines effortlessly with automated report generation and submission capabilities.

- Global Compliance: DataTracks supports FATCA reporting for various jurisdictions, offering a one-stop solution for your global operations.

Wrapping Up:

Overall, FATCA/CRS represents a step towards greater global transparency in financial matters. Efforts are ongoing to address its initial challenges. DataTracks helps FFIs globally streamline FATCA compliance by providing software, data management tools, and compliance expertise.

Ensuring compliance with FATCA reporting services can be a complex and time-consuming process, especially when managing accounts across multiple geographies and business units. This is where DataTracks steps in, offering a comprehensive solution to simplify FATCA services for the global region. For more details on DataTracks FATCA services specific to the EU region, contact us at +31 20 225 3702 or email enquiry@datatracks.eu.