Overview of AIFMD Delegation and Letterboxing

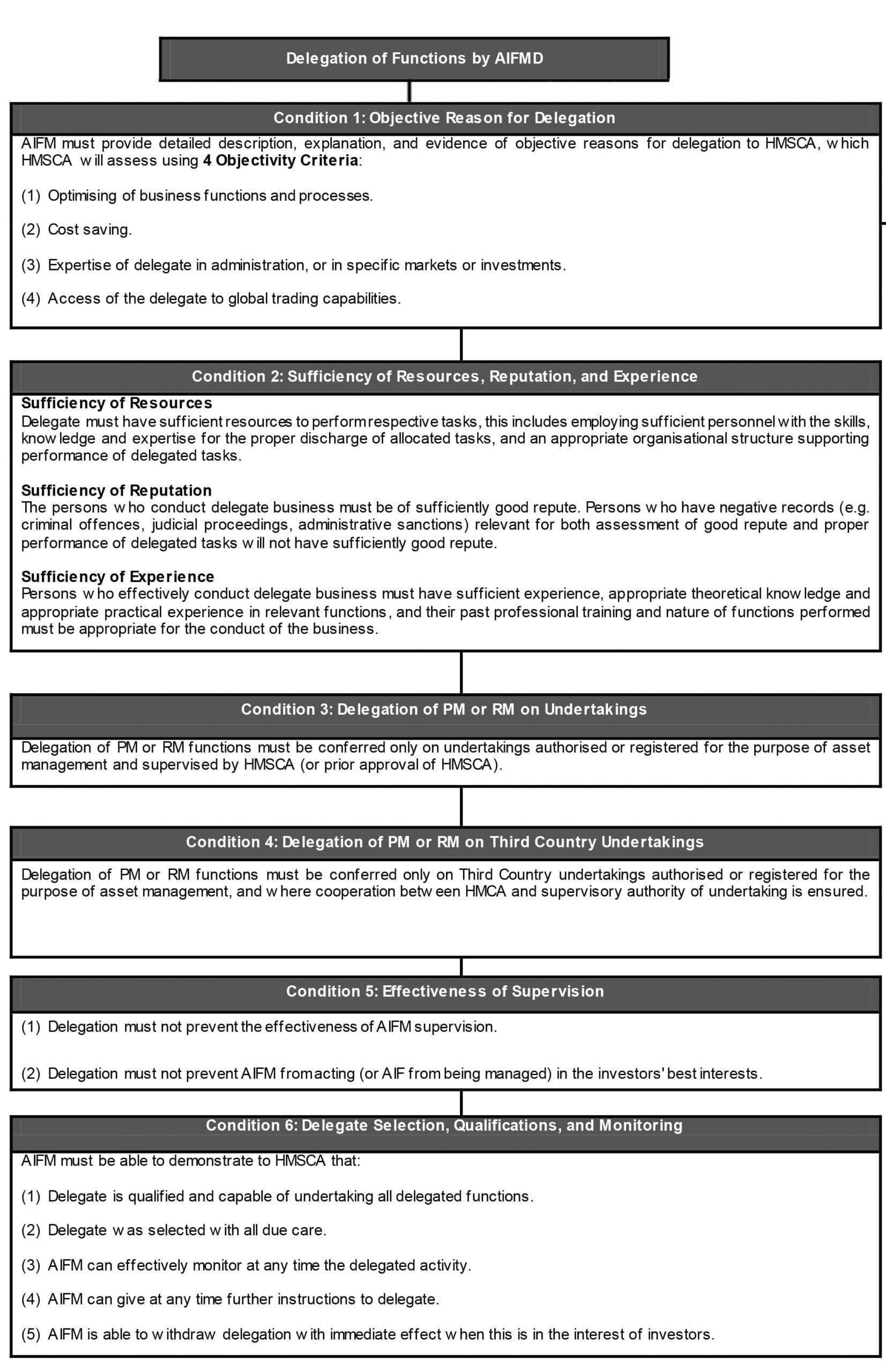

In the European Union (EU) there are a number of different entities that may be appointed as the Alternative Investment Fund Manager (AIFM) under the Alternative Investment Fund Managers Directive (AIFMD) (2011/61/EU), e.g. investment manager, management company, self-managed fund. However, given the extensive range of new regulatory compliance, portfolio management, and risk management requirements under the AIFMD, many AIFMs will now be looking to delegate these and other functions to the Alternative Investment Fund (AIF) fund itself, or alternatively a third party. Although delegation of functions is permitted under the AIFMD, any delegation must adhere to a number of delegation requirements. The Overview of AIFMD delegation requirements only apply to Investment Management (IM) functions and other functions, and not to any other technical or administrative tasks.

Investment Management Functions

IM functions include:

(1) portfolio management (PM); and

(2) risk management (RM).

Other Functions

Other functions when managing an AIF are:

(1) administration functions;

(2) marketing functions; and

(3) activities related to AIF assets.

These final activities are services necessary to meet the fiduciary duties of the AIFM, facilities management, real estate administration activities, advice to undertakings on capital structure, industrial strategy and related matters, advice and advice services relating to mergers and the purchase of undertakings and other services connected to AIF management, or the management of companies and other assets in which it has invested.

Administrative Functions

Administration functions are further defined to include:

(1) legal and fund management accounting services;

(2) customer inquiries;

(3) valuation and pricing (including tax returns);

(4) regulatory compliance monitoring;

(5) unit-/shareholder register maintenance;

(6) income distribution;

(7) unit/shares issues and redemptions;

(8) contract settlements (including dispatching certificates); and

(9) record keeping.

The requirements relating to delegation of investment management and other functions are to be supervised by Home Member State Competent Authorities (HMSCA). Although AIFMs must retain decision-making authority over PM and RM, they are able to choose to perform one of either of these functions only. It should also be noted that any delegation or sub-delegation of functions will not affect the AIFM’s liability towards the AIF and its investors. In addition to satisfying AIFMD delegation requirements, AIFMs must also comply with twelve general principles relating to delegation.

12 General Principles of Delegation

The twelve general principles of delegation are:

(1) the AIFMD must ensure that the delegation structure does not allow circumvention of the AIFM’s liability or responsibilities;

(2) that the AIFM’s obligations towards AIF investors are not altered because of the delegation;

(3) the conditions that the AIFMD must comply with for authorisation and carrying out of activities are not undermined;

(4) that the delegation arrangement is set out in a written agreement between the AIFM and delegate;

(5) that the AIFM ensures delegate carries out delegated functions effectively and complies with all applicable law and regulatory requirements;

(6) that the AIFM has at all times the necessary expertise and resources to supervise the delegated functions;

(7) that the AIFM ensures the continuity and quality of delegated functions in the event of termination of delegation;

(8) that all AIFM and delegate respective rights and obligations are set out in the agreement;

(9) that delegation is in accordance with the AIF investment policy (for PM);

(10) that AIFM ensures that delegate discloses to AIFM any development that may have a material impact on delegate’s ability to carry out delegated functions effectively and in compliance with applicable laws and regulatory requirements;

(11) that the AIFM ensures that the delegate protects any confidential information relating to the AIFM, the AIF affected by the delegation, and the AIF investors; and

(12) the AIFM ensures that the delegate establishes, implements, and maintains a contingency plan for disaster recovery, as well as periodic testing of backup facilities (taking into account the types of delegated functions).

As can be seen from the very broad range of delegation requirements, conditions, and qualitative criteria specified in the AIFMD delegation and letter-box entity provisions, accurately assessing whether an AIFMD has satisfied these requirements may become a highly complex issue for many AIFMs. Indeed, the inherently subjective nature of the qualitative criteria means that AIFMs that are not retaining a significant proportion of IM functions may be in danger of being classified letter-box entities by HMSCA. Consequently, AIFMDs would be well advised to ensure that they have put in place a ‘Delegation of Functions’ document that comprehensively and effectively evidences and demonstrates how the AIFMD has addressed and satisfied all AIFMD delegation conditions and qualitative criteria for each AIF it manages.

If you would like to discuss any of the implications of AIFMD on your business, or for more information on our AIFMD reporting solutions and prices, please email DataTracks at: enquiry@datatracks.co.uk.