CRS Compliance Made Easy: A Step-by-Step Guide for Financial Institutions

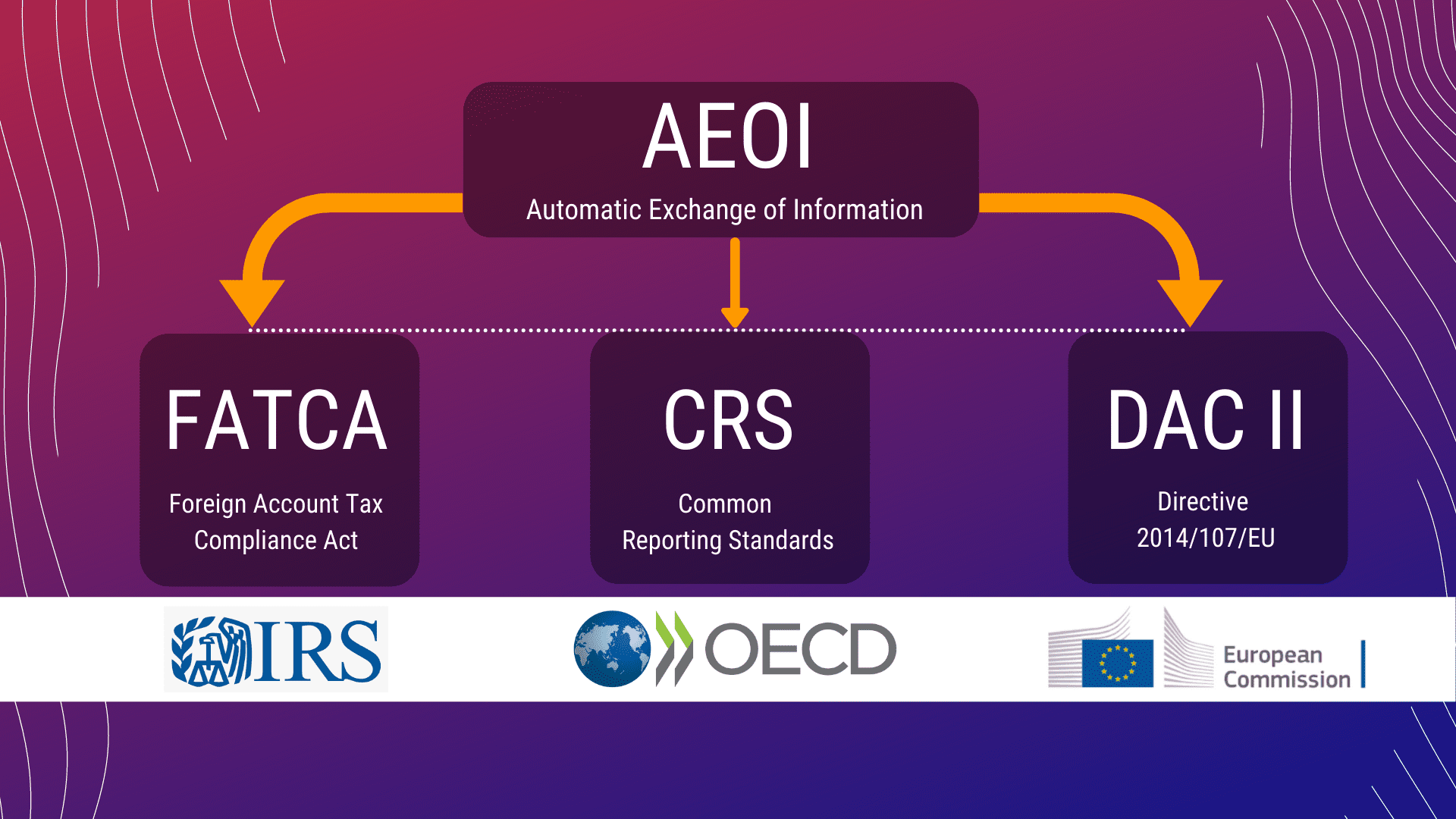

The Common Reporting Standard (CRS) is developed by the Organisation for Economic Co-operation and Development (OECD). It is a global standard used to automatically exchange financial account information. The primary goal of CRS is to combat tax evasion by supplying tax authorities with detailed information about foreign accounts owned by their citizens.

According to CRS compliance requirements, foreign financial institutions (FFIs) are mandated to identify the account holder’s tax residency and disclose their financial accounts to local tax authorities.

EU members have widely adopted CRS, making it an important part of the European Union’s efforts to increase tax compliance and combat tax evasion. FATCA and CRS compliance is more than just a legislative requirement for EU financial institutions; it is also part of a movement towards transparency and fairness.

How to Comply With CRS Requirements?

CRS compliance requirements are undoubtedly complex. However, financial institutions can make the process easy with the following step-by-step guide. Let’s delve deeper.

Correct Classification and Registration

Ensure that all financial institutions under their management are properly classified in accordance with the CRS criteria. Additionally, all products that fall under the scope of CRS reporting obligations should be correctly identified.

Governance and Control Measures

Develop strong governance structures and control systems to monitor CRS compliance processes. This involves an annual review of these structures to evaluate their effectiveness and responsiveness to any changes in CRS standards. Financial institutions should document all their policies and procedures

Multi-Jurisdictional Compliance Support

Institutions subject to these requirements must ensure that their reporting adheres to the CRS-specific schema and that they understand the required taxonomies. Additionally, each CRS report generated should meet the established criteria by various jurisdictions

Validating the Reports for CRS Compliance

Validation ensures that the reports comply with FATCA/CRS rules and regulations. This procedure not only finds problems and suggests changes, but it also reduces the risk of submitting inaccurate reports. It is a vital step in guaranteeing compliance and the integrity of the reporting process.

Staying Updated With Reporting Changes

The regulatory framework can evolve during or after implementation. A CRS solution that is agile and adaptable can quickly respond to the changes. Moreover, it is also important to keep track of filing deadlines for timely and accurate compliance.

Data Management and Cleaning

Institutions should regularly analyse and clean their data to maintain its accuracy and completeness. This should be a continuous procedure throughout the year to reduce errors prior to the reporting period.

Quick Response to Information Requests

Respond immediately to any tax-related surveys or information requests. This displays the institution’s commitment to compliance and openness.

Independent External Review

This can help evaluate the financial institution’s governance, compliance processes, and data to provide significant insights. An objective assessment can discover potential shortcomings in the procedures and suggest improvements

Early Engagement With Tax Authorities

If the institutions notice any errors or discrepancies in their reporting, they should contact the tax authorities as soon as possible. This enables the discussion of potential remedial measures and helps reduce penalties.

Bottom Line

Adopting a consistent compliance framework and centralising data management can considerably boost productivity for financial institutions in an ever-changing landscape of regulatory demands.

To ensure accurate and comprehensive reporting, financial professionals must have a thorough awareness of the CRS framework, its objectives, and the specific needs of the CRS compliance form. Financial institutions must excel in identifying reportable companies and accounts in accordance with CRS requirements and understand due diligence and reporting mandates. Furthermore, they should be capable of managing client onboarding processes, adapting to changing conditions, preparing for reporting, and effectively handling prospective audits.

Why DataTracks?

The ever-changing regulatory framework can make CRS compliance challenging – but not with DataTracks! The professionals at DataTracks ensure FATCA CRS compliance and ease the reporting process for financial institutions. With 19 years of experience in multiple taxonomies, our XML experts have prepared more than 400,000 reports for 28,000+ clients. All the reports are generated according to the IRD/OECD requirements. Furthermore, the in-built validation engine of the DataTracks solution ensures that error-free, compliant reports are prepared and submitted.

DataTracks aims to enhance the reporting workflow for foreign financial institutions by addressing the complex challenges of FATCA and CRS reporting. So, if you are looking for hassle-free CRS reporting, contact DataTracks experts at +31202253702 or email enquiry@datatracks.eu TODAY!