What is iXBRL? Differences between XBRL and iXBRL

XBRL (eXtensible Business Reporting Language) is an open technology standard for financial reporting, based on XML (eXtensible Markup Language). XML, in its original form, is a markup language that defines the manner in which the documents can be encoded, making them human-readable as well as machine-readable.

XML is primarily used in encoding documents and other arbitrary data structures for exchange over the Internet/World Wide Web.

XBRL is an XML based, open, market-driven, global standard for encoding semantic information, like those found in financial statements of organizations. Many countries along with their respective financial regulators, have together promoted the adoption of XBRL as a universal electronic financial reporting mechanism.

iXBRL (Inline XBRL) is a development of XBRL, where the main enhancement is centered around the electronic rendering of financial information encoded in an XBRL document. If the focus of XBRL is on automated machine readability of data, iXBRL focuses on rendering such data.

Technically, iXBRL documents are generated from well-formed XML documents. While XBRL documents can be viewed only with specialized XBRL viewers, iXBRL documents can be viewed on standard browsers.

Essentially, both XBRL and iXBRL standards exist with the same objective – seamless exchange of financial data. iXBRL goes a step further, to enable the rendering such data in a visually appealing format.

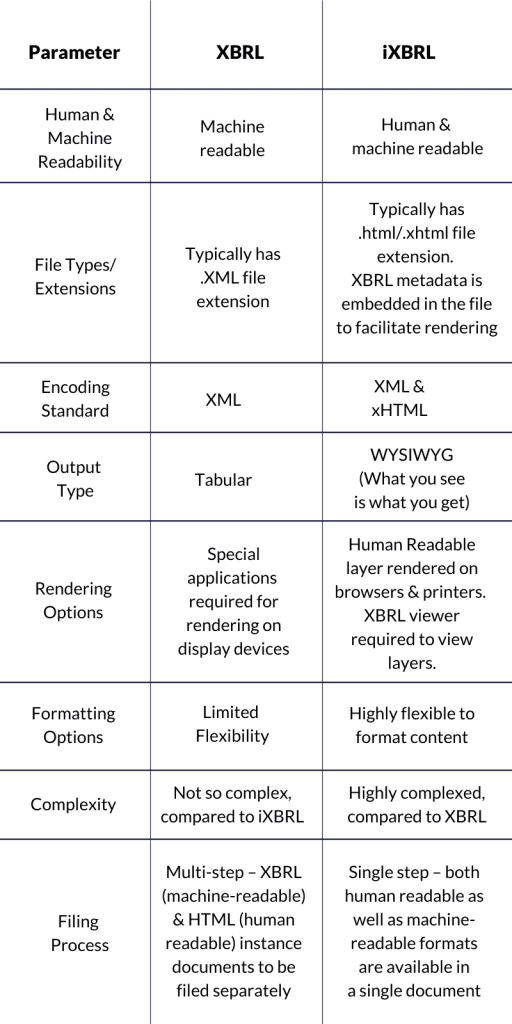

The table below gives a comparison between the various parameters of iXBRL and XBRL:

There are two main ways of producing iXBRL documents:

- A program can generate the iXBRL file from a given source data

- A word processing package which is enhanced to handle the XBRL tags

As on the date, UK is the only region where iXBRL filing is mandatory. In the UK, HM Revenue and Customs (HMRC) requires businesses to submit their reports, accounts and tax computations in iXBRL format when filing their Corporation Tax return. Businesses and their agents can use HMRC’s Online Filing software to prepare their reports, accounts and tax computations in iXBRL format or they can prepare the iXBRL files by themselves and submit them to HMRC.

In essence, while both XBRL and iXBRL serve the fundamental purpose of standardizing financial reporting, iXBRL offers enhanced accessibility and usability, bridging the gap between technical financial data and stakeholders’ need for understandable and analyzable financial reports.

To know how we can simplify your compliance reporting with our iXBRL Tagging Services, get in touch with a XBRL expert