MTD VAT return filing from 1 November 2022

What is Making Tax Digital for VAT Businesses?

Making Tax Digital for VAT is a UK government initiative enabling taxpayers and businesses to maintain VAT records and file returns digitally to HMRC.

What is the Key Update from HMRC?

Starting 1 November 2022, all VAT-registered businesses submitting monthly or quarterly VAT returns will no longer be able to use their existing VAT account to file returns and must be doing it only through MTD-compatible software.

The businesses filing VAT returns annually will be able to use the existing VAT account until May 15 2023.

What has to be done now?

Now, quickly let’s remind ourselves of what has to be done to avoid noncompliance and penalties. Simple 3-step process,

- Business currently needs to prepare and keeps digital records

- Choose MTD-compatible software – so that they can file VAT returns easily

- Sign up for MTD and file future VAT returns using MTD-compatible software

Are there any exemptions?

Yes, a business or taxpayer is automatically exempt from MTD for VAT if in insolvency.

HMRC does consider exemption applications on a case-to-case basis for the below.

- Age, Disability or Location

- Not using computers due to religious causes

- Valid reason why it’s not practical

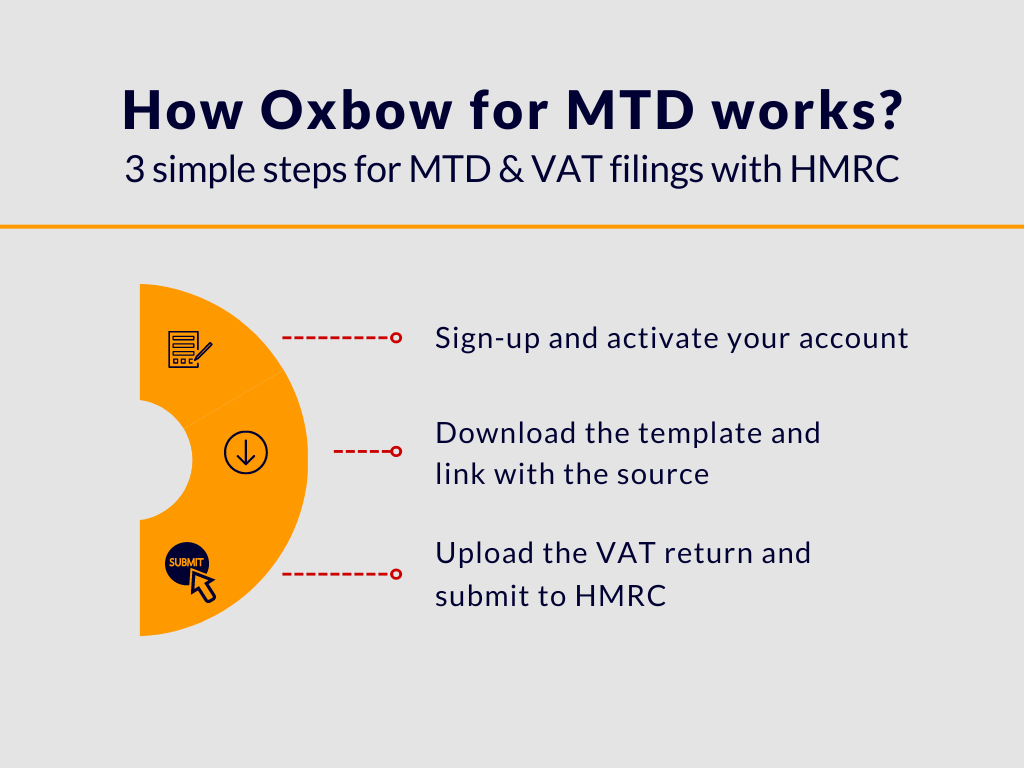

How does DataTracks Oxbow for MTD help?

DataTracks, a software provider recognized by HMRC for supporting Making Tax Digital (MTD) for VAT, enables seamless and smooth VAT filing with HMRC.

DataTracks Oxbow for MTD is suitable for all levels of businesses and agencies. It allows people to keep using Excel spreadsheets to store their data and then file their VAT returns with HMRC while meeting all the requirements of MTD.

No complexity, no extensive software, hassle-free, straightforward, user-friendly: BRIDGE SOFTWARE.

Interested in partnering and piloting with us for MTD ITSA 2024? Connect with us today.

DataTracks is in business since 2005, provides software & services to prepare compliance reports in 26 countries and more than 21,500 clients with a rich experience of helping prepare more than 350,000 reports since inception. We provide cloud-based software solutions to help organizations prepare compliance reports for filing with regulators worldwide such as SEC in the United States, ESMA, EBA, and EIOPA in the European Union, HMRC in the United Kingdom, ACRA in Singapore, SSM in Malaysia, CIPC in South Africa and MCA in India.