Record Highs in 2021 Global Dealmaking

2021, touted to be the year of the ‘Great Reset,’ has been one of recovery and innovation.

It is, therefore, not surprising that since January of 2021, deals to the tune of $4tn have been effected. In this blog, we bring you some thoughts on how hectic the summer of 2021 has been for the financial markets and how this could well be the year when global deal-making breaks records and sets new benchmarks.

Overall, the three leading causes for giving an impetus to the value of deals in 2021 has been:

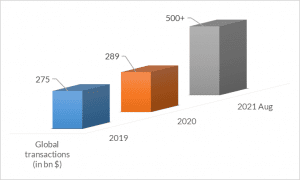

Compared to $275bn in 2019 and $289bn 2020, 2021 had already cashed in over $500bn in global transactions as of August.

Market analysts and leading financial professionals expect the M&A activity of 2021 to continue over the next 12 months.

Some even speculate that this year may surpass the record of 2006 when close to $4.3tn worth of deals were announced.

Almost 40,000 deals have gone through since the start of the year, and most of them have been significant in value and scale. Cross-border associations have been popular such as the $30bn deal by General Electric to sell its aircraft-leasing unit to AerCap.

One of the sectors that have enjoyed double-digit increases in deal-making is Technology. In 2000, the tech boom contributed to a solid upward trend in deals. Since then, 21% share in M&A activity achieved in 2021 has been its highest till date outrunning its 16% from last year.

According to industry stalwarts, the real currency that high valuations provide to tech currencies makes it easy to afford critical acquisitions. In turn, it boosts their stock valuations and makes them attractive to potential target companies.

The pandemic has also added a thrust to the increased importance of tech in business for more efficiency and connectivity through digitization and automation. These have also been pivotal contributors to the success of this sector.

This flurry of deal-making has not only helped in giving Wall Street revenues a boost but has also led to economic growth. If these trends continue, we may well be on our way to a renewed economy that is primed for a positive transformation.

To know how we can simplify compliance reporting for public companies, investors, attorneys and SPACs, talk to an XBRL expert to know more.