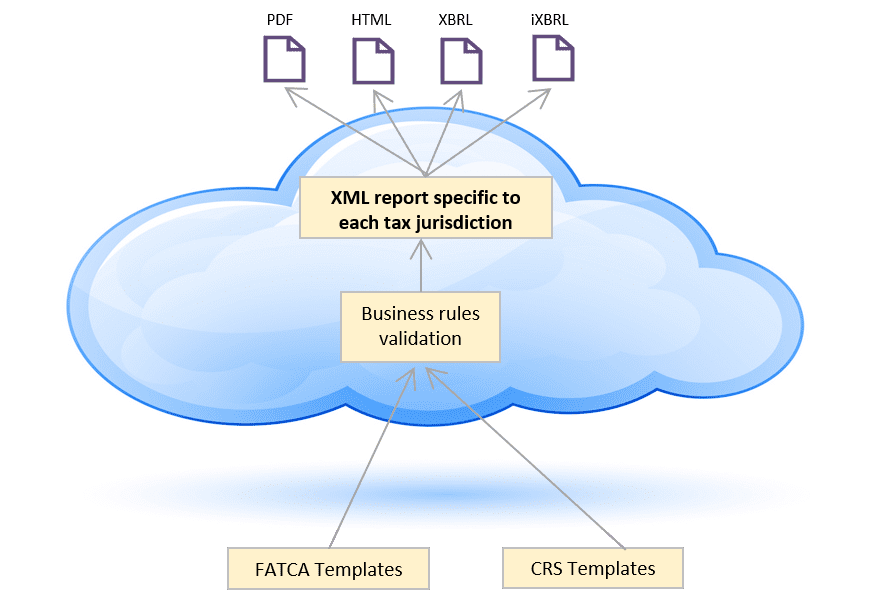

The Foreign Account Tax Compliance Act (or FATCA) and Common Reporting Standard (or CRS) regime were brought into force to detect and bring into record undisclosed assets held by citizens in foreign countries by imposing reporting obligations on the Financial Institutions of each participating country. With DataTracks’ one-stop solution for all FATCA/CRS regimes, compliance has become easier and simpler by uploading pre-mapped Excel template and generating jurisdiction specific XML output.

Are you a Financial Institution having foreign accounts?

Do you need to submit reports for filing with respective tax authorities?

Under FATCA or CRS regime?

With ease? With accuracy? In time?

Consider licensing DataTracks Rainbow for in-house use.

Or, consider using fully assisted service from DataTracks.