Private Limited Companies in the UK

Dealing with the current global crisis is most likely every company’s primary goal at the moment. While this is important and necessary, the aspect of compliance with governmental rules on tax is equally, if not more integral to an organization’s smooth functioning.

In recent years, managing tax compliance has become a complex task that consumes most of a company’s time and manpower. The evolving reporting obligations, changes in legislation, and penalties for non-compliance have all undergone a transformation in these times of uncertainty. Therefore, reading through the filing obligations and accurate tax return submission procedures is key to prudent administrative planning.

A Private Limited Company owned in the UK must prepare the following at the end of its financial year:

- Complete statutory accounts for the year

- Accounts to be submitted for Company Tax returns

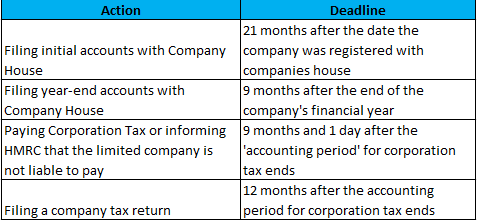

These two important facets need to meet the deadlines specified by Companies House and HM Revenue and Customs (HMRC)

The Process of Filing

A company’s accounts are filed with the Companies House and the Company Tax returns are filed with HM Revenue and Customs (HMRC). If the Private Limited Company does not require an auditor, both can be filed together.

Options Available

- Filing Accounts and Tax Returns together >> Should be done through HMRC’s online service or accounting software

- Filing separately with Companies House (only accounts) >> Online despatch of accounts to Companies House

- Filing separately with HMRC (tax returns) >> Should be done through HMRC’s online service or accounting software

Details Required to Successfully Complete the Filing Process:

- Account details to access HMRC online

- The registration number assigned to the

- Account details to access Companies House online

Another option available to Private Limited Companies is to seek the help of accountants and tax advisers to help with the filing process. These experts, such as us, have experience and keen knowledge on the intricacies involved in the filing process and complying to the rules. In case the Private Limited Company is choosing to take this route, the accountant or tax professional can be given the authentication code to file accounts with the Companies House. To outsource filing Company Tax returns, an agent or organization specialized in the process is employed who will then proceed to perform the task.

Now that we have provided clarity on how to file accounts and Tax returns for Private Limited Companies, we would like to take a moment to give you some information about DataTracks. We have experience in assisting a spectrum of companies from start-ups to large corporations with all tax compliance activities. We take pride in being able to help you make time to focus on furthering your business goals. Do discuss more on how we can help you, get in touch an iXBRL expert.