HMRC’s experience with iXBRL data

After four years of successful implementation of iXBRL, HMRC has shared its experience on high quality analysis. The iXBRL has been proven advantageous to HMRC and has provided an improved reporting and analysis capability for tax authorities. It has also helped HMRC to reduce the related costs of recording the data. The primary use of XBRL is to define and exchange financial information, such as financial statements, in a computer readable format. The data available in XBRL can be compared amidst those of thousands of taxpayers who are submitting their accounts in this computer readable format.

HMRC is also planning for significant changes to the iXBRL submission in order to ensure the quality of XBRL fillings is sustained and the basic purpose of XBRL implementation is met. The biggest change is the HMRC’s requirement for detailed level tagging of Profit and Loss Statement where all the expense items need to be tagged with the standard taxonomy element. This requirement will be implemented in the UK GAAP, the IFRS Statutory Accounts and the Corporation Tax XBRL taxonomies. HMRC has also stated that they will be making structural changes to the Corporation Tax XBRL taxonomy.

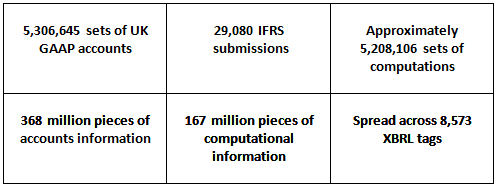

Facts related to the HMRC iXBRL submissions:

There are some difficulties highlighted by HMRC which are causing some challenges in using the available iXBRL data. They have pointed out some of the common errors that are found in the iXBRL filings. These include:

- Tagging monetary items as text strings;

- Applying incorrect scale to monetary tags (£10m tagged as just £10);

- Using the incorrect date for a tag;

- Applying an incorrect currency to a value;

- Incorrect use of the negation principle (polarity issues);

- Failing to tag one or more of the Business Mandatory Tags;

- Incorrect tagging and variation in element selection by the filers

HMRC is paying more detailed attention to the returns which appear to lack the expected amount of tagging, filed by the filers. HMRC is also working in close consultation with the software partners to improve their products and services. In order to ensure the complete tagging of data with precise standard elements HMRC has proposed:

- Introduction of new detailed profit and loss account extension taxonomy

- Improvements to the structure of the HMRC computation taxonomy

- New accounts taxonomies (FRS taxonomies)

How Managed Tagging Services (MTS) providers like DataTracks can help companies

Our Accountants at DataTracks review all filings for XBRL errors. Companies using our services are cognisant of the positive benefits as their iXBRL files are free from the above-mentioned issues. Apart from review by professional Accountants, we also have validation software that runs your iXBRL accounts through some rigorous rules check.

As a process, DataTracks ensures all detectable errors are handled before delivering iXBRL files to companies. Although it is important to note that each company’s XBRL flings are ultimately the responsibility of the company’s management team, choosing a high quality XBRL partner can bring a significant difference including enhanced quality to your tax filing with HMRC.

About DataTracks:

DTracks Limited is a subsidiary of DataTracks Services Limited. With a track record exceeding 9 years, DataTracks is a global leader in preparation of financial statements in XBRL and iXBRL formats for filing with regulators. DataTracks prepares more than 12,000 XBRL statements annually, for filing with regulators such as SEC in the United States, HMRC in the United Kingdom, Revenue in Ireland and MCA in India.

To find out more about DataTracks UK, or send an email to enquiry@datatracks.co.uk

The views expressed are that of the author’s and DataTracks is not responsible for the contents or views expressed therein. If any part of this blog is incorrect, inappropriate or violates any person’s or organization’s IP rights, please alert us at ceo@datatracks.com. We will take immediate action to correct any violation.