What Happens If You Don’t Submit Your XBRL Financial Statements to ACRA?

Since the introduction of XBRL, all Singapore-based companies are required to file financial statements with ACRA, except those exempted. Some companies must file a full set of XBRL financial statements, while others must file only key financial data in the XBRL format along with a full set of a signed copy of the FS.

But did you know that XBRL ACRA can take enforcement action and impose a composition sum if your company doesn’t file the annual return on time?

Indeed, there is a late lodgment fee associated with delayed submissions, which could escalate to court prosecution if the company or its directors do not accept the composition offer, or if ACRA chooses not to offer compensation for these violations. This underscores the critical nature of timely and accurate financial reporting through XBRL, highlighting the system’s role in maintaining regulatory compliance and minimizing legal risks for businesses.

The timeline for filing the Annual Return (AR) to ACRA and the consequences for non-compliance, including late filing penalties and composition fines, are as follows:

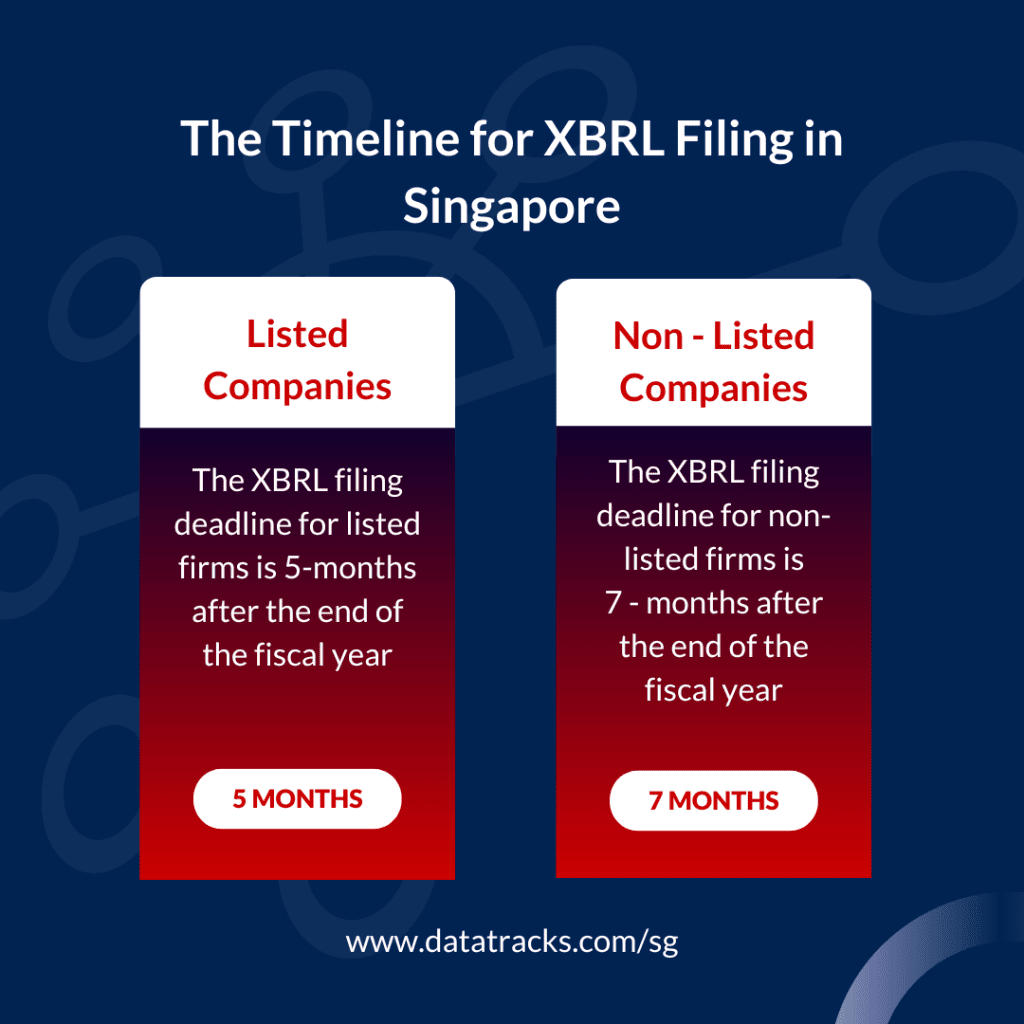

The deadlines for filing Annual Returns (AR) with the Accounting and Corporate Regulatory Authority (ACRA) in Singapore vary based on the type of company and certain specific conditions. Here are the guidelines:

- Listed Companies: According to the Section 197 of the Companies Act (CA), Every listed company must file its AR within 5 months after the end of its financial year.

- Other Companies: All other companies are required to file their AR within 7 months after their financial year-end.

- Listed Companies with Share Capital Maintaining a Register Outside Singapore: For listed companies that have share capital and maintain a register outside of Singapore, the AR must be filed within 6 months after the financial year-end.

- Other Companies with Share Capital Keeping the Branch Register Outside Singapore: For all other companies that have share capital and keep the branch register outside Singapore, the AR must be filed within 8 months after the financial year-end.

Consequences of Non-filing XBRL ACRA

- Composition Fine

According to Section 197 of the Companies Act, companies that file an annual return after the due date must pay a late filing penalty of $300-500, depending upon the breach.

- Disqualification

Under Section 155 of the CA, companies and directors convicted of three or more filing offenses within 5 years will be disqualified as a director. And once disqualified, the individual will not be allowed to become a director at any other company or manage any local or foreign company for 5 years.

- Striking Off

If there’s a reasonable cause to believe that a company is not carrying out any business or operations, ACRA may choose to disqualify the directors and strike off the company.

- Court Prosecution

XBRL ACRA may choose to prosecute the directors for late lodgement or failure to lodge annual returns. In such a case, if the court convicts the directors or the company’s representatives, a fine of up to $5,000 per charge may be levied and a default penalty may be imposed. Further, for more severe breaches under section 201, the penalty can increase to $10,000 or up to 2 years of imprisonment.

For more information about enforcement actions against defaulter companies and directors, please follow the link

Stay tuned and read the DataTracks blog to know more about the filing and compliance requirements of ACRA.