Which Submission is Required to ACRA: Simplified XBRL or Full Set Financials in XBRL?

Every Singapore-based company is required, by law, to submit their financial statements in the XBRL format to ACRA. Therefore, it is imperative to understand the compliance requirements from ACRA and come up with a plan to stay on top of your financials. This article can help you understand the filing requirements you need to fulfil to comply with ACRA and a solution of how to do it effectively.

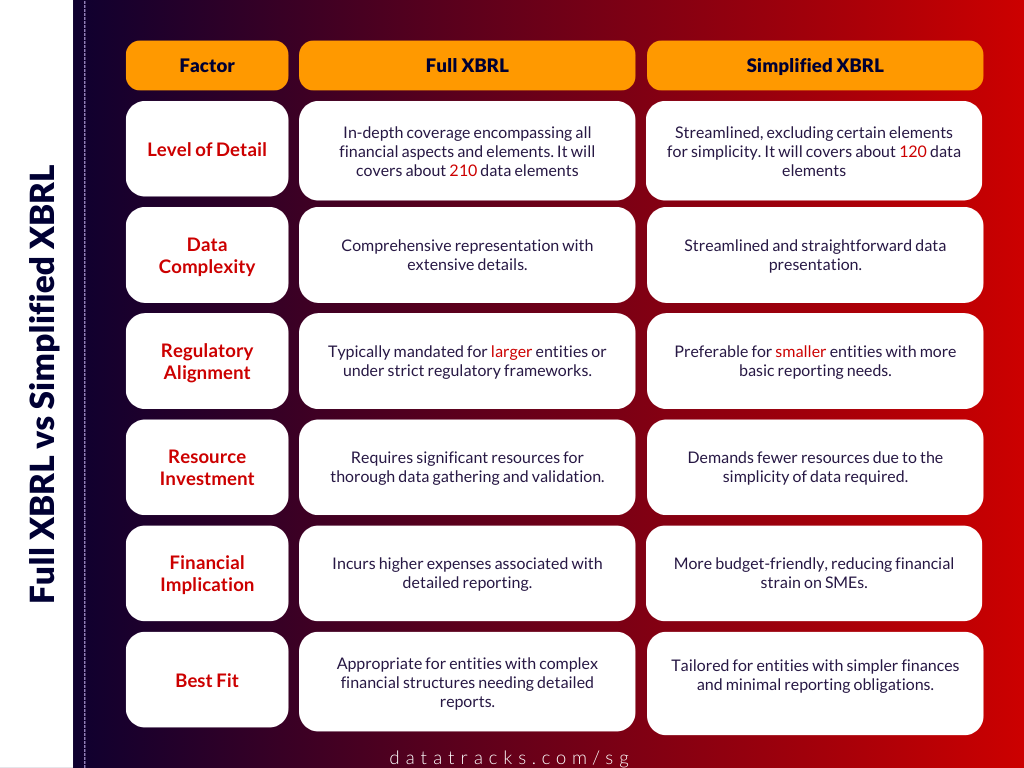

Now, some of the companies are given the advantage to submit said financials in a simplified XBRL format, which entails only the highlights of operations throughout the financial year. Others have to submit their annual returns in the full XBRL format.

Which category does your company belong to? Let’s find out.

The extent of XBRL filing varies on the company’s nature and size of operations. In retrospect, a small and non-publicly accountable company needs to file financial statements in a simplified XBRL format along with a PDF copy of financial statements authorised by the directors. And, all companies other than small and non-publicly accountable are required to file financial statements in the full XBRL format.

Determining the appropriate XBRL (eXtensible Business Reporting Language) filing requirement for your company in Singapore depends on several factors, including the nature, size, and accountability of your business. It’s crucial to understand these distinctions to ensure compliance with ACRA’s (Accounting and Corporate Regulatory Authority) filing standards.

Small and Non-Publicly Accountable Companies

These entities are typically smaller in scale and do not hold public accountability. Their financial reporting obligations are tailored to reflect their simpler operational and financial structures. For such companies, the filing requirements are less stringent, necessitating the submission of financial statements in a Simplified XBRL format.

This format focuses on a subset of about 120 data elements that capture the essential financial information without delving into the complexities unnecessary for smaller business contexts.

Additionally, these companies must provide a PDF copy of the full financial statements, as authorized by the company directors, to offer a comprehensive view of their financial health without the detailed granularity required from larger entities.

All Other Companies

This category encompasses entities that do not qualify as small and non-publicly accountable, including larger businesses and those that are publicly accountable. These companies face a more rigorous reporting standard and are required to file their financial statements in the Full XBRL format.

This comprehensive format includes approximately 210 data elements, covering not just the primary financial statements but also selected notes and disclosures that provide a detailed account of the company’s financial performance and position.

This level of detail is necessary for stakeholders, including investors, creditors, and regulatory bodies, to fully assess the financial health and operations of the company.

The distinction between the Simplified and Full XBRL filings reflects ACRA’s approach to streamline the reporting process for smaller companies while maintaining strict reporting standards for larger or publicly accountable entities. This tiered approach ensures that the financial reporting requirements are proportionate to the size and complexity of the company’s operations, promoting transparency and accountability across Singapore’s corporate landscape.

Meaning of Small and Non-publicly Accountable Companies

● Introduction to Small Companies

A company whose revenue and total assets for the current financial year do not exceed S$500,000 respectively. The amount of total assets and revenue is determined based on the rules stated under the Companies Act.

● Introduction to Non-publicly Accountable Company

Your company belongs to this category if it is not:-

➔ Listed on a securities exchange board in Singapore or is in the process of issuing debt or equity instruments for trading in one.

➔ It is listed on an exchange board outside Singapore.

➔ One of the following financial institutions:-

➢ An entity that is part of the banking and payment systems

➢ Licensed insurer

➢ Capital market infrastructure provider

➢ Capital markets intermediary

➢ Licensed trade repository

➢ Authorised and exempt benchmark administrator under the Securities and Futures Act trustee-Manager of listed registered business trust

In conclusion, if your company doesn’t fall under any of these categories, you are required to file financial statements in the full XBRL format.

Leave Your XBRL Worries at Bay

These compliances and innumerable filing requirements from ACRA may seem daunting, but with an XBRL connoisseur like DataTracks by your side, you can relax and focus on your core business operations. Boasting 15+ years of commendable track record and 185,000 compliance reports, DataTracks has gained proficiency in error-free XBRL filing. So you can rest assured of quality XBRL filing and conversions when partnering with an expert like DataTracks.

For more information about their services, please speak to an XBRL expert @ +65-315-836-54.

Frequently Asked Questions on Full vs Simplified XBRL Filing

What is a Full XBRL Filing?

The full XBRL (eXtensible Business Reporting Language) filing in Singapore is a comprehensive digital format for submitting financial statements. It incorporates around 210 data elements that encapsulate the core information found in primary financial statements and selected notes, providing a detailed view of a company’s financial health.

What Documents Are Required for a Full XBRL Filing?

To ensure a complete and accurate XBRL filing, the following documents are required:

- Statement of Financial Position: Outlines the company’s assets, liabilities, and equity at a given moment, reflecting its current financial status.

- Statement of Profit or Loss: Demonstrates the company’s financial performance over a certain period, detailing income, expenses, and net profit or loss.

- Statement of Changes in Equity: Chronicles the changes in equity throughout the reporting period, including adjustments due to profits, losses, dividends, and other factors.

- Cash Flow Statement: Highlights the flow of cash and cash equivalents, broken down into operating, investing, and financing activities, showing how cash is generated and used.

- Notes to the Financial Statements or Comparative Information: Provides additional context and details beyond the figures, such as accounting policies, financial risk management practices, and any comparative information, to deepen understanding and analysis.

Why are notes and comparative information important in an XBRL filing?

Notes and comparative information enrich the financial statements, offering critical insights into the accounting methodologies applied, the management of financial risks, and providing a basis for comparison. This information is vital for stakeholders to accurately interpret the financial health and operational performance of the company.

What is Simplified XBRL Filing?

A simplified XBRL filing is a more concise method of financial reporting, with around 120 financial data elements, as opposed to the 210 elements in a full XBRL filing. This model excludes some complex financial details and notes that are unnecessary for simpler financial reporting situations.

Crafted for small to medium-sized enterprises (SMEs), simplified XBRL filing is tailored for organisations with straightforward financial structures and modest reporting requirements. Moreover, this filing method is budget-friendly, making it a feasible choice for small and medium-sized enterprises interested in handling their reporting costs without going over their budgets.

Is your company required to submit full or simplified XBRL templates?

The filing requirements for XBRL will be determined by the size and complexity of your company’s financial structure. When it comes to filing XBRL, larger companies may have specific requirements, while smaller and non-publicly accountable companies have the option to go for a simplified approach. In this context, a small company refers to a company with revenue and total assets below S$500,000 for the current financial year.