Your Tax Season Can be Hassle-free; here’s How

If you are an entrepreneur, you have suffered the after-effects of Covid-19, not the virus infection but the disruption of processes and operations. And probably, you don’t ever want to think about 2020 again. Well, after this tax season, you won’t have to. But until then, stay up-to-date with everything new this tax season and make it hassle-free with these practical tips. Let’s get started.

Top 3 Tips to Handle Tax Season – Effortlessly:

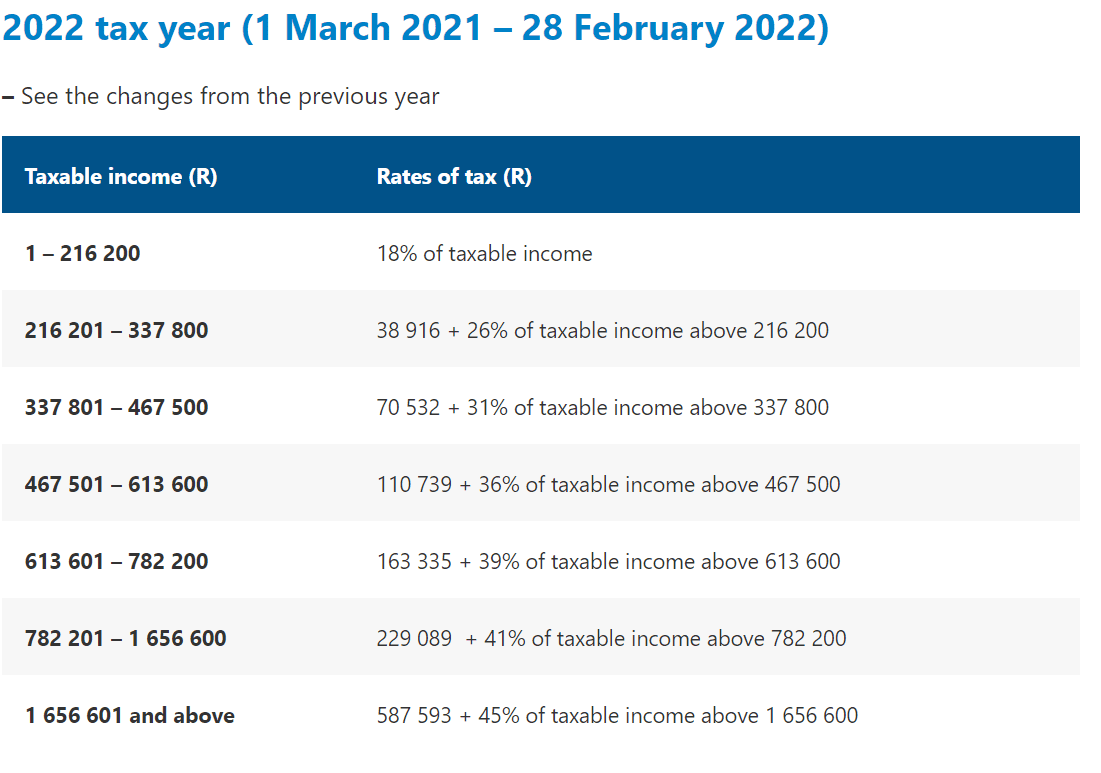

Tip #1 Stay Up-to-Date, The Income Brackets and Rates Have Changed

Source: https://www.sars.gov.za/tax-rates/income-tax/rates-of-tax-for-individuals/

The tax rate is directly proportional to your income range. Due to Covid-19, the government has offered several relaxations and has allowed multiple rebate options wherein individuals and organizations can adjust or itemize deductions to their accounts.

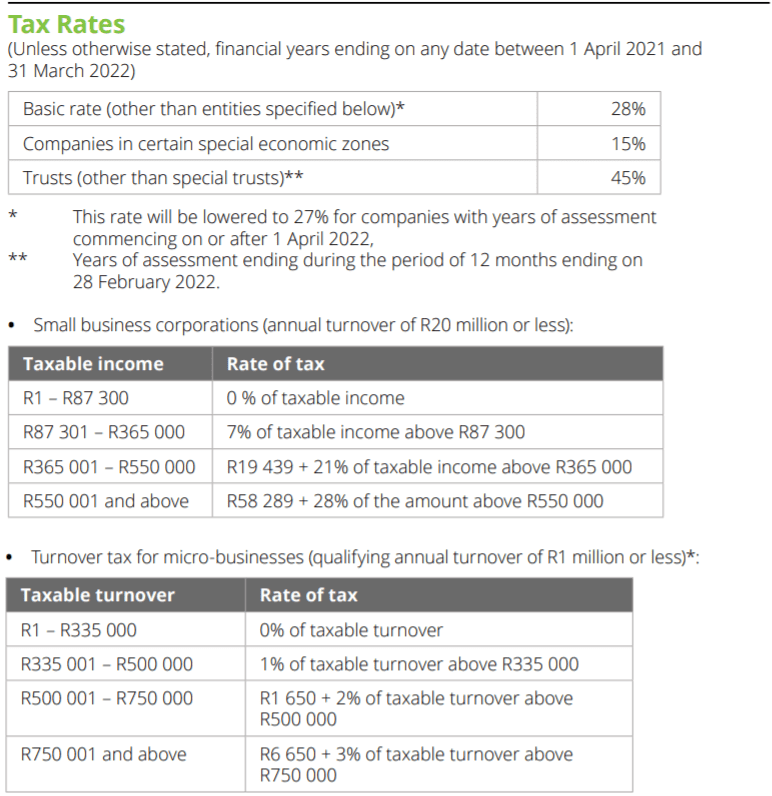

If you are filing tax returns for your company, please refer to the below table for the latest tax rates.

So whether you are filing your individual income tax return or your company’s, ensure you have the full picture of the tax rates and rebates. Reach out to your CA or CPA for more information.

Tip #2 Ditch the File Storage Boxes and Move to the Cloud

Do you still keep your invoices, purchase orders, and receipts in a storage box or files?

The time to upgrade was yesterday. The entire world is entering the digital realm, so should you; it’s safe, secure, and hassle-free. As a business owner, you need to toss aside your file cabinet or storage box and move to the cloud.

There are several technology-powered cloud storage solutions that have a more efficient filing system, high security, and integration features. Leverage these solutions for accounting, bookkeeping, even filing financial statements with the CIPC.

Tip #3: Don’t Forget to Consider the Tax Deductions and Credits

For the tax year 2022, the following tax deductions and rebates will apply:-

- ZAR 15,714 for all natural persons, also known as primary rebate

- ZAR 8,613 for taxpayers => 65 years, also known as secondary rebate

- ZAR 2,871 for taxpayers => 75 years, also known as a tertiary rebate.

Source: https://taxsummaries.pwc.com/south-africa/individual/other-tax-credits-and-incentives

If you are filing a tax return for your organization, consider capital allowances on movable assets, plant & machinery, R&D assets, etc. You’ll need to seek expert guidance from a chartered accountant or CPA for more information.

Time to Call in the Experts and Get Your Taxes Right

Filing taxes is pretty straightforward if you have a degree in finance or understand the accounting jargon. If that’s not the case, you need to seek professional guidance. Whether you choose to hire one in-house or outsource the filing process, make sure the tax expert has experience and expertise in the domain. An understanding of iXBRL won’t hurt as you’ll also need to file your company’s annual return with the CIPC.

Simply put, make your tax filing process hassle-free by following these tips or bring in reinforcements.

Follow the DataTracks blog @ https://www.datatracks.com/za/cipc/blog/ for more information about tax regulations and compliance requirements in South Africa.