4 challenges faced while filing compliance reports with SEC

SEC reporting and filing is a square maze. It’s all structured, but there is only a distinct path that can take you to safety. Hence, it is not surprising to know that your organization’s finance team is probably on its toes every quarter.

Reporting mandates and disclosure terms leave no room for sidestepping or error. It can add to the pressure for publicly traded companies’ executives to draw up an accurate report for submission to the regulatory authority.

An efficient solution to ease the burden? Partner with a Fully Managed Services provider for SEC compliance. Lending a hand in streamlining the reporting and compliance process with alleviating error and pressure, the advent of this advancement can revolutionize the reporting landscape. Read on to learn more about the most common reporting challenges and how a seasoned end-to-end service provider can be a viable solution.

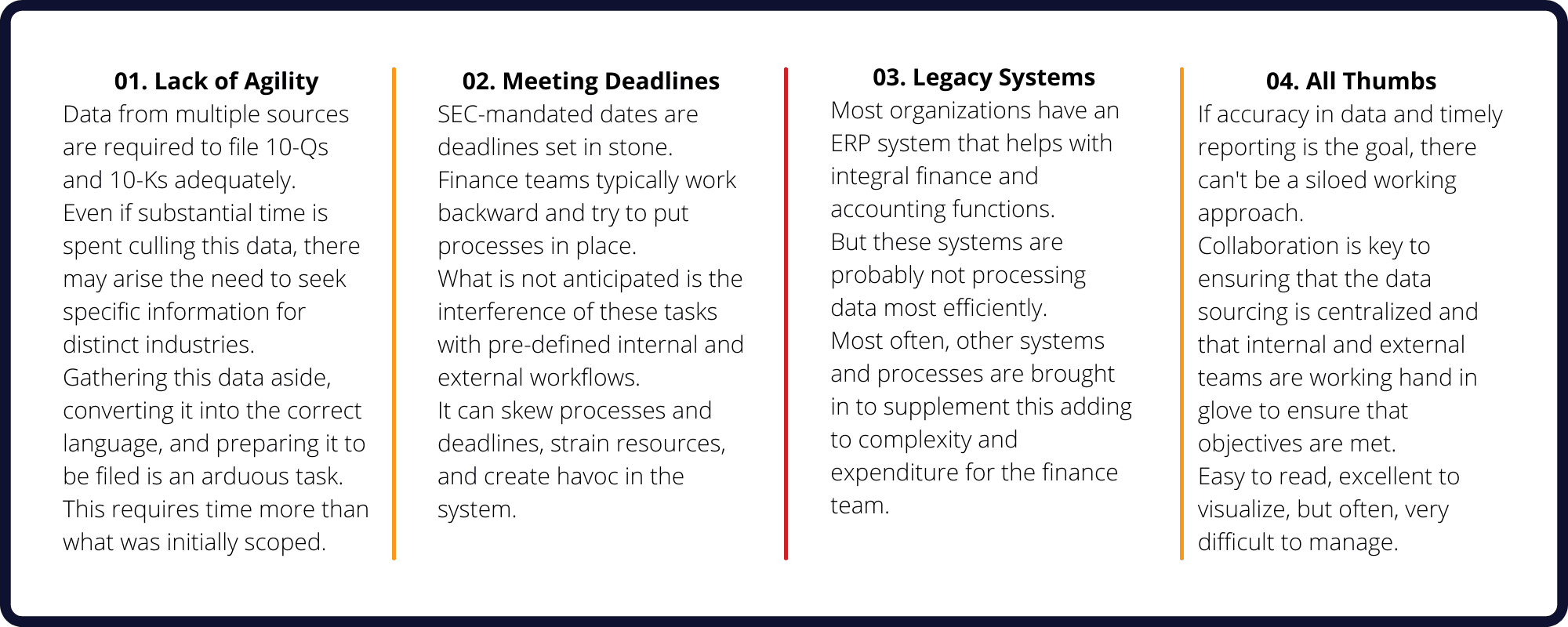

Quarterly and annual SEC filings do take up a significant chunk of process orientation. Most organizations do not pay keen attention to the time and resources that these needs, and almost all the time, face these challenges:

So, what do you do to overcome these? A new data management system or perhaps amp up resourcing. But there is a far more sustainable solution. Automation and technological advancement have paved the way for cloud-based solutions that can utilize resources efficiently, enhance collaboration and lead to timely completion of tasks.

– Most service providers offer software that can automate administrative burden. Report-wide data tagging, auto-update of tagging when rolled forward, and even role hierarchies and section assigns can help stick to deadlines and accurate work.

– Most cloud-based software solutions can be integrated with existing systems to bridge shortcomings in ERP or Excel.

– Software can assist with direct submission to the regulator, saving you the worry of completing the task successfully.

– The software providers can offer services that can potentially eliminate the need for a separate team in-house. They can assist with data sourcing, number crunching, and report creation, leaving you free to focus on other critical tasks.

In summary, regulatory reporting always comes with a host of challenges in tow.

(1) You can invest in a software and prepare compliance reports with your own team or

(2) partner with a Fully Managed Service Provider and relieve the additional responsibility of compliance reporting.

We manage over 800+clients in the US and have delivered over 17,000 XBRL reports and 84,000 EDGAR filings for our clients regulated by SEC.

While this blog has skimmed the surface of how we can help, you can get in touch with an iXBRL expert to know more about how we can simplify compliance reporting for you.